Senators’ selling of stocks stirs controversy

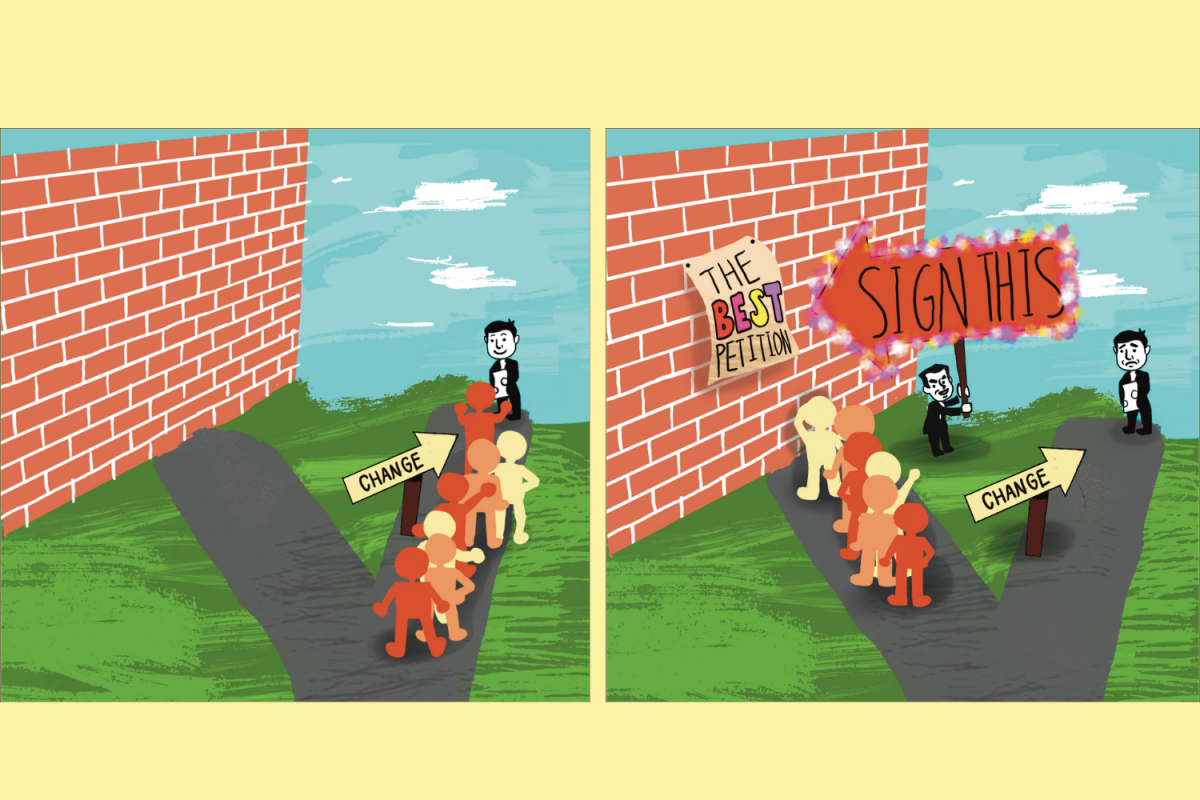

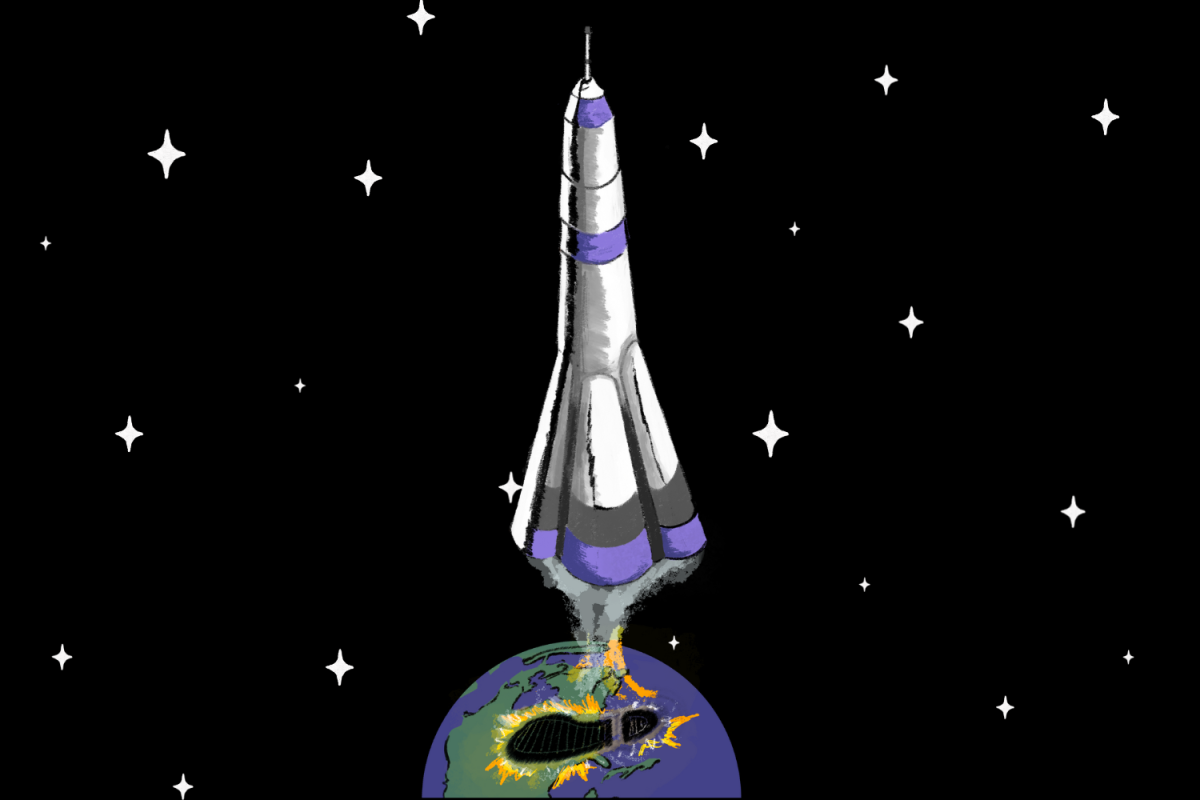

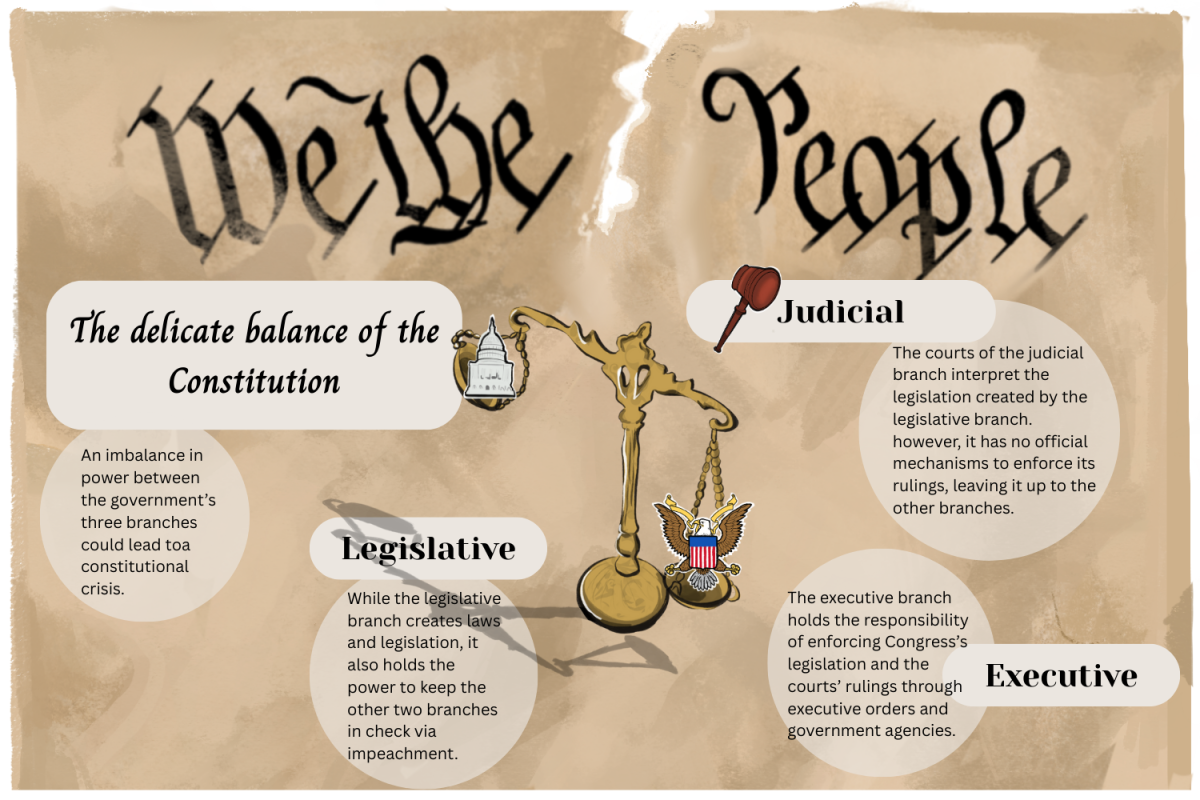

Graphic illustration by Katie Chen and Bennie Chang

Senators Kelly Loeffler and Richard Burr used their political offices to their benefits before the pandemic’s effects had fully materialized.

May 25, 2020

The coronavirus outbreak has impacted billions of individuals around the globe and widened the disparity between the privileged and the disadvantaged. Before the pandemic’s effects had fully materialized in the U.S., two of the powerful decided to use their political offices to their benefits: Senators Kelly Loeffler and Richard Burr.

Prior to the economic meltdown in Feb. 2020, Americans were gallantly strolling down Time Square and partying on Miami beaches while their Congressional leaders were huddled behind closed doors with President Donald Trump, receiving briefings on the impacts of the virus around the globe. After leaving a meeting with the president on Jan. 24, 2020, Loeffler’s third-party stock brokers sold 21 of her stocks, worth up to a staggering $3.1 million, before the economic fallout resulting from the pandemic.

Loeffler defended herself in response to backlash surrounding the possibility of the use of insider information by clarifying the way in which her stocks are managed, in the hopes of assuaging attacks.

“Our family’s investments have long been managed by outside investment advisors at Morgan Stanley, Goldman Sachs, Speio Capital, and Wells Fargos,” Loeffler said in a public statement. “They make their investment decisions for our accounts, including buying and selling securities like stocks and options — without our input, direction or knowledge.”

Because they often have other affairs to look after, the wealthy like Loeffler often entrust their fortunes to experts or third-party stock brokers who manage their stock portfolio. Although this is the case for Loeffler, Economics Club President and Junior State of America Public Relations officer Ian Chen doubts that any third party stock brokers would make any such big decisions without consulting their clients.

“[Third-party stock brokers] do not make big changes to your portfolio without telling you,” Chen said. “No financial advisor just sells off your entire portfolio on a whim. Those are all decisions that the client has to approve, so Loeffler’s defense is a bit questionable.”

Many Americans are concerned about the recent string of cases of Senators selling off stock when the American economy was still stable.

“These hedge funds make decisions based on data, and if you do not have accurate information, people do not trade because they are scared, especially portfolio managers,” Chen said. “They trade because there are numbers or they know information, so the only reason they would sell off is because they know something is going to happen. How would they know that?”

Recently appointed following the retirement of Senator John Isakson, Loeffler is currently facing a special election. However, Chen believes that Loeffler will still be able to surmount a win in both the primary and general election despite this controversy due to her incumbency and party affiliation.

However, Burr is not as fortunate. As chairman of the Senate Intelligence Committee, he sold as much $1.7 million worth of his stocks — all in one day. Although he does not face reelection, having announced his retirement following the end of his term in 2022, he is under FBI investigation for insider trading. On top of Burr’s suspicious sellings, his brother-in-law Gerald Fauth also sold hundreds of thousands of dollars’ worth of stock on the same day.

“I relied solely on public news reports to guide my decision regarding the sale of stocks on February 13,” Burr said in a public statement. “Specifically, I closely followed CNBC’s daily health and science reporting out of its Asia bureaus at the time. Understanding the assumption many could make in hindsight however, I spoke this morning with the chairman of the Senate Ethics Committee and asked him to open a complete review of the matter with full transparency.”

Burr’s openness in allowing the Senate Ethics Committee to investigate the matter has done little to reassure the American public, as well as other politicians. Recently, his defense has been drowned out by more reports of corruption and mismanagement. While he was on television downplaying the seriousness of the virus, he was offloading stocks that were to be heavily affected — hotel, restaurants and shipping — and warning close business of the significant impact.

On May 13, news broke from the Los Angeles Times that the FBI had seized Burr’s phone after handing his lawyers a warrant. With allegations that there was insider trading, the country’s top bureau is looking for incriminating evidence in the forms of texts and emails to close family and allies that would prove he had been using private, government information to help himself and those close to him. Depending on the seizure, the whole case hangs in a precarious situation.

“At the end of the day, insider trading is always one of those things where it is really easy to see but always really hard to actually prove in a court of law,” Chen said. “There is not really any way you can specifically prove that they were insider trading beyond a reasonable doubt. As a result of the FBI’s involvement, Burr resigned as the chairman of the Senate Intelligence Committee in hopes of alleviating the [distractions] to the hard work of the committee.” Many called for him to step down as Senator before the end of his term, but a resignation may reflect an admission of guilt and not even stop the investigation.

Although the controversy has been largely focused on Loeffler and Burr, others in politics have dumped stocks before the outbreak as well. Oklahoma’s senator Jim Inhofe, who sold much less, and California’s own senator Dianne Feinstein have gone under the radar. For Feinstein, she did not personally sell stocks, but her husband did sell off as much as $6 million dollars.

“I have no input into his decisions,” Feinstein said. “My husband in January and February sold shares of a cancer therapy company. This company is unrelated to any work on the coronavirus and the sale was unrelated to the situation.”

Similarly to Burr, Feinstein was questioned by the FBI but was vindicated of any wrongdoings by providing documents to show that she was not involved in the decision.

Senators’ stock sell-off has caused anger in the U.S., but no legal action has taken place yet. Americans are now resigned to waiting for evidence to convict or vindicate the senators’ actions.