A guide to loans, financial aid and scholarships

March 29, 2019

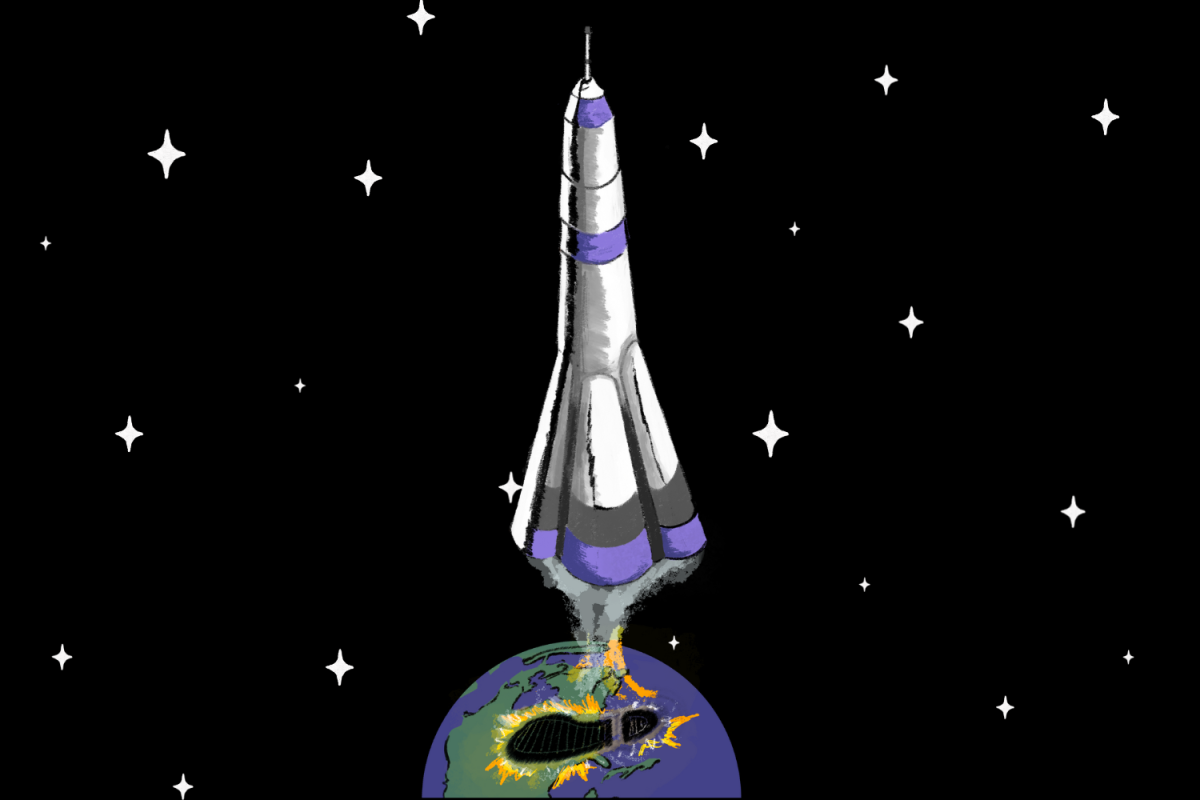

Being accepted into a dream college requires hard work, but so does figuring out how to pay for it. In fact, according to EDVestinU, 72 percent of those aged 46 and older continue to stress over their monthly student loan payments, and the average bachelor’s degree holder takes 21 years to pay off student loans. According to Citizens Financial Group, one out of four graduates admit that they would have chosen a cheaper school if they had known how much debt they would acquire. With the Free Application for Federal Student Aid (FAFSA), merit scholarships, federal and private loans and the sheer amount of effort required to pay off student loans, figuring out how to finance a college education can feel like a complicated maze. Although considerable research is required, here are some great resources to start the search.

FAFSA

FAFSA is a way for federal institutions and colleges to determine a student’s eligibility for financial aid. In order to file a FAFSA, the student’s parents’ federal tax information, employment information and bank statements are required. In addition, some colleges require a College Scholarship Service profile (CSS) through College Board in order to be applicable for need-based financial aid. The FAFSA should be filled out during the college application process. If chosen for federal financial aid, students will receive a financial aid offer that may include federal loans.

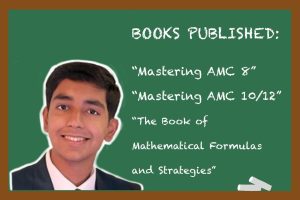

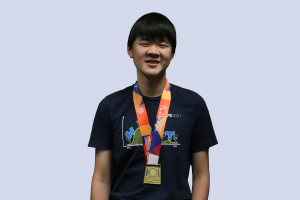

MERIT SCHOLARSHIPS

Merit scholarships are awarded to students based on their accomplishments in and out of school. Merit scholarships can be earned through academics, athletics and even the arts. Some schools consider all applicants for merit scholarships, while some require a separate scholarship application or some require students to submit applications by an early deadline. Merit aid might cover a student’s entire tuition, or it might be a one-time grant. However, merit scholarships often have conditions, such as maintaining a certain GPA, or achieving a certain benchmark in sports. These stipulations are worth keeping in mind, and it is wise to speak with a representative from the college to clarify the finer details. Additionally, students who take the PSAT can qualify for the National Merit Scholarship Program, which will give out more than $42 million in student aid in 2019.

FEDERAL LOANS

Federal loans are provided by the government, and they are divided into two categories: direct subsidized loans and direct unsubsidized loans. For direct subsidized loans, the government pays the interest while the student is enrolled in college. These loans are only available to students with financial need, as determined by FAFSA. For direct unsubsidized loans, the borrowers are responsible for any interest that is accumulated while they are in school or afterwards. Direct unsubsidized loans are available to any graduate or undergraduate student. Additionally, most federal loans do not require a cosigner, someone who is obligated to pay the debt if the student is unable to do so.

In most cases, the interest rate for a federal loan is locked, meaning that the interest will be calculated with a fixed percentage no matter how long it takes to be repaid. Federal loans are strictly regulated, which means that students will not be charged over-inflated interest rates, and can expect stronger security measures.

PRIVATE LOANS

Private loans can be offered by a bank, credit union, school or state organization. Interest rates for these loans may vary with the market; interest rate policies depend on the lender and should be factored into a student’s payment plans. Some private loans may require the student to begin payments while they are still in college.