Before the pandemic, San Francisco’s streets were bustling with tourists, restaurants were packed and malls were crowded with shoppers. As one of the top four cities in the United States in terms of Gross Domestic Product, San Francisco has long been a hot spot for tourists and has prospered economically. However, its economy took a huge hit during COVID-19, and has yet to fully recover.

Acquired by the United States in 1846, San Francisco has become one of the 10 largest cities in the nation. As a city, San Francisco has gone through many changes, such as the 1849 Gold Rush, the 1906 earthquake and recent downfalls with high-tech businesses.

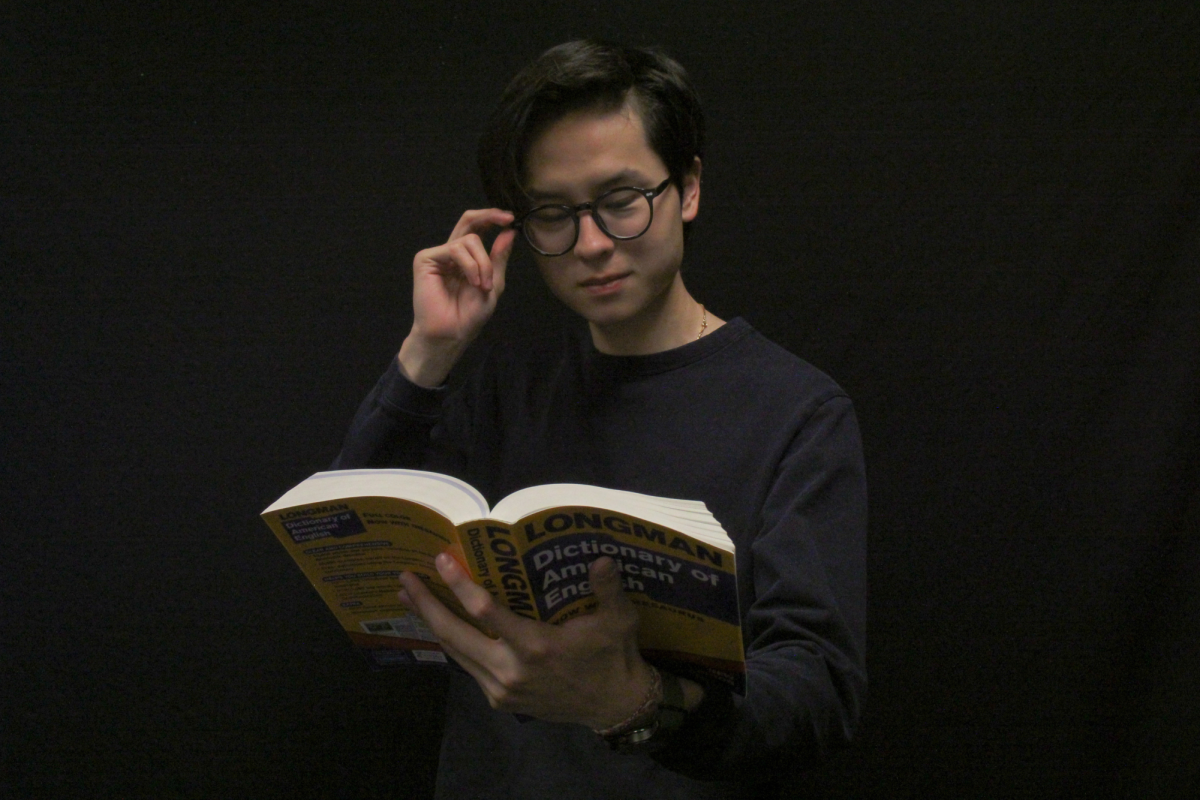

“Somewhere in the late 90s, businesses started to move away from San Francisco, and into the greater Silicon Valley area — Cupertino, Saratoga, Sunnyvale and Mountain View — causing San Francisco to change,” said Ninh Nguyen, an economics professor at San Jose State University.

Recently, the San Francisco economy has been losing its steam, suffering severe hits in tourism and the housing market. Prior to COVID-19, more than 25 million people visited San Francisco each year, with the city making an average of $10 billion annually from tourism alone. According to the San Francisco Chronicle, between 2011 and 2019, San Francisco ranked fourth overall on inclusive growth, but between 2019 and 2021, the region tumbled to 109th based on data collected. The steep decline in tourism during COVID-19 for many big cities like San Francisco heavily factored into its economic suffering. Although COVID-19 restrictions have been lifted and tourism has resumed, the economy is still nowhere near where it was before the pandemic.

“It’s very difficult for an average middle-income family to live in San Francisco right now and enjoy a lifestyle that isn’t super expensive,” history teacher Mike Williams said. “San Francisco is a wonderful city, it’s just really expensive.”

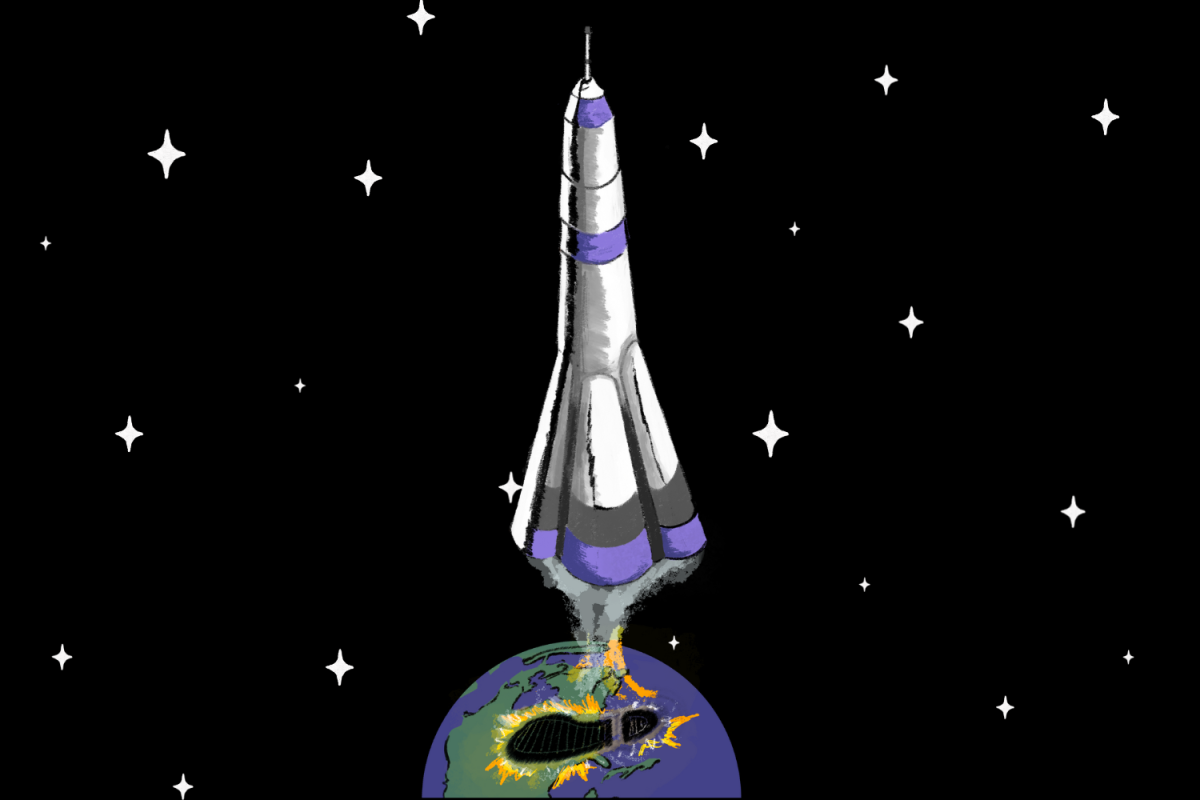

The uneven distribution of wealth present in San Francisco contributes to the ongoing gentrification of San Francisco, with an influx of affluent individuals purchasing and renting properties. This drives up housing costs, making it increasingly difficult for the average person to afford living in the city. Outside of housing, people with middle and low incomes who live in San Francisco also face other daily challenges to maintain a reasonably priced lifestyle.

The pandemic not only affected tourism but also influenced the living situations of many local residents, with many tech workers opting to move away from their costly San Francisco apartments to work remotely. On average, workers at high-tech companies in San Francisco are only back in offices three days a week. According to the SFGate, San Francisco has an office vacancy rate of 33.9% as of September 2023 — a record high. This created a major hurdle for many businesses in San Francisco, such as restaurants, shops and small businesses that became increasingly dependent on business from tech workers.

Aside from individual businesses moving away, one of San Francisco’s biggest attractions, Westfield Mall, is in the process of closing. As a result of the rising rates of online shoppers during COVID-19, many consumers didn’t return to stores, making malls less profitable and sustainable. Back in 2002, Westfield invested a substantial $460 million for the expansion of the mall, but recent financial struggles have led to the corporation defaulting on $558 million in loans. Sales plummeted from $455 million in 2019 to a mere $298 million in 2022, prompting the mall to transfer management to its lenders as they were unable to pay back loans.

“Closing the Westfield Mall was a loss for San Francisco because it’s known to have a lot of retail and contributed to the San Francisco economy,” senior Ritam Chakraborty said. “However, at the same time, the government will have to pay less to keep up these malls, which could be beneficial in the long term.”

The downfall of the mall is also represented in the decrease in foot traffic. In 2019, more than 9 million people visited and shopped at the mall, but this number has dwindled to nearly 5 million by 2022. Another factor that contributed to the mall’s shutdown is the escalating crime and shoplifting rates. The recent surge in criminal threats has deterred shoppers from coming and has posed risks to retail workers. Some analysts blame the increasing crime rates on the passage of California’s Proposition 47, which decriminalized theft under $950. Other prevalent crimes include vehicle theft, which is also on the rise in San Francisco. This has frustrated many residents and tourists, who have had to take extra precautions to ensure that their belongings are safe.

“I don’t visit San Francisco as often as I used to because a lot of the stores have been closing and I feel like the city has become less safe,” junior and Economics Club officer Irene Chung said.

In addition to shoplifting, San Francisco has recently faced many other safety concerns, including homelessness. Homelessness has risen in San Francisco, with the city reporting that over 20,000 residents experience homelessness each year.

“I visited San Francisco a lot as a kid, and I remember seeing many homeless people on the streets, which influenced my view of the city,” Chakraborty said.

Part of the reason that many people have a negative perception of the city is due to the media’s exaggerated portrayal of the homelessness and crime, which makes it seem more dangerous than it really is. Although crime and homelessness have increased, most of the news coverage is concentrated in the downtown areas, where crime rates are disproportionately high. This can lead to people having a false impression to the extent to which the city is in decline.

On the positive side, San Francisco has experienced an extended period of low-interest rates since the 2008 financial crisis that has lasted for approximately 12-15 years. This has benefited various generations of investors, including real estate, apartment and stock investors. However, one concern is that the prolonged period of low-interest rates will create a false sense of security and could lead to bad policy decisions.

“The reality is, the economy can’t be perpetually increasing forever,” Nguyen said. “If everyone’s getting raises every year, that presumes that the tax rates and the value of property have to rise.”

Politicians, especially in areas like San Francisco, may have become accustomed to rising real estate prices and increased tax revenues. This may create challenges if the economy becomes stagnant in the future.

“It’s important to understand that our economy is truly cyclical in nature,” Nguyen said. “Typically, we think of the business cycle as being up or down, and this is why the economy optically looks bad, but it’s really not the economy per se — it’s how the tax revenue is mismanaged.”

Although San Francisco’s economy seems gloomy right now, through investing in small businesses, supporting new events and improving public spaces, residents may help steer the economy around. Mayor London Breed remains hopeful about its future; earlier this year, she released a roadmap for the future that utilizes San Francisco’s vibrant downtown to reinvigorate the San Francisco economy. The plan calls for a more inviting downtown area led by clean streets and enhanced public spaces. While it might take some time for the city’s economy to bounce back, it’s on the right track to be successful in the long term.