Silicon Valley Bank failure leads to unrest

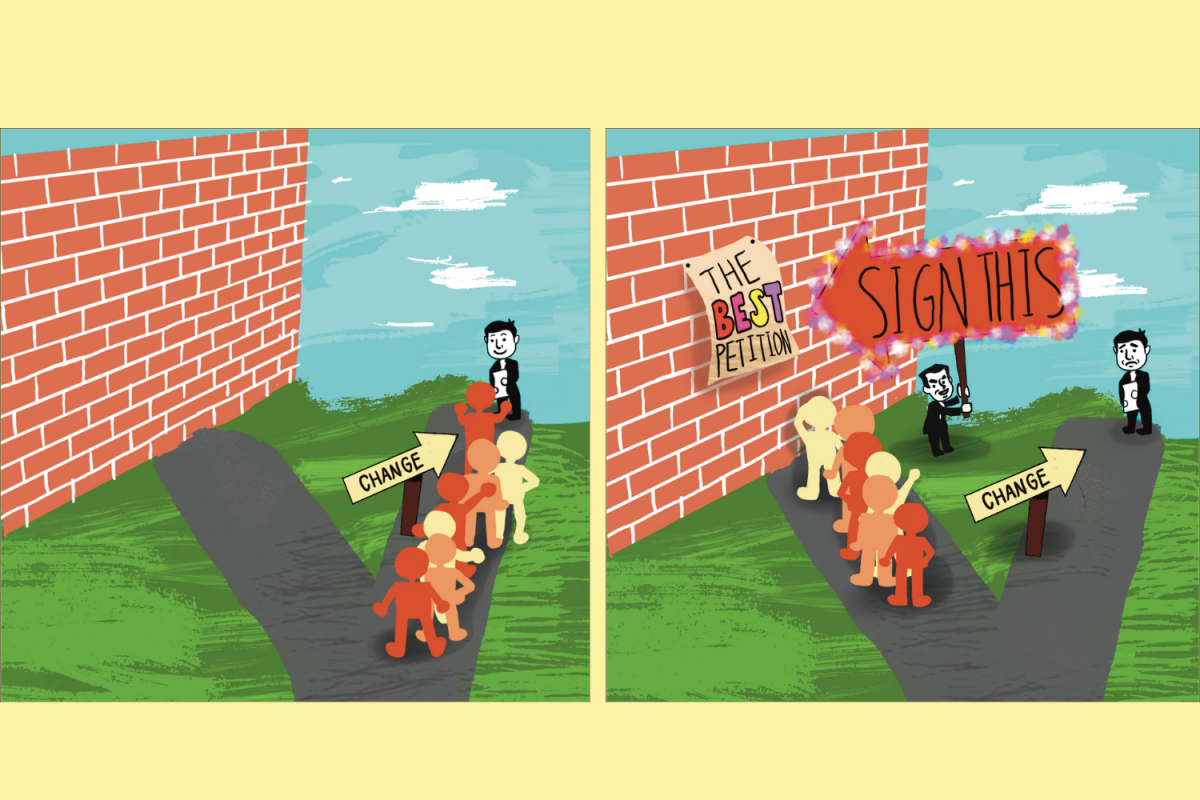

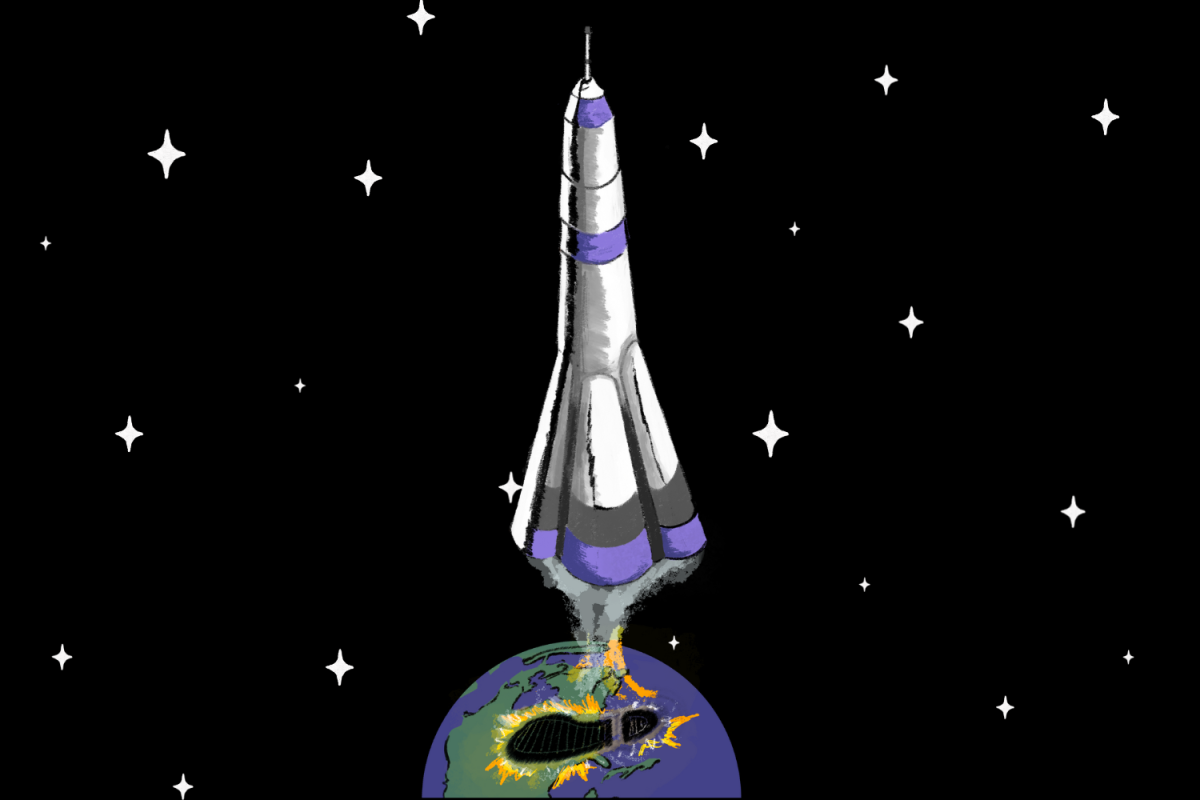

Graphic illustrations by Sarah Zhang

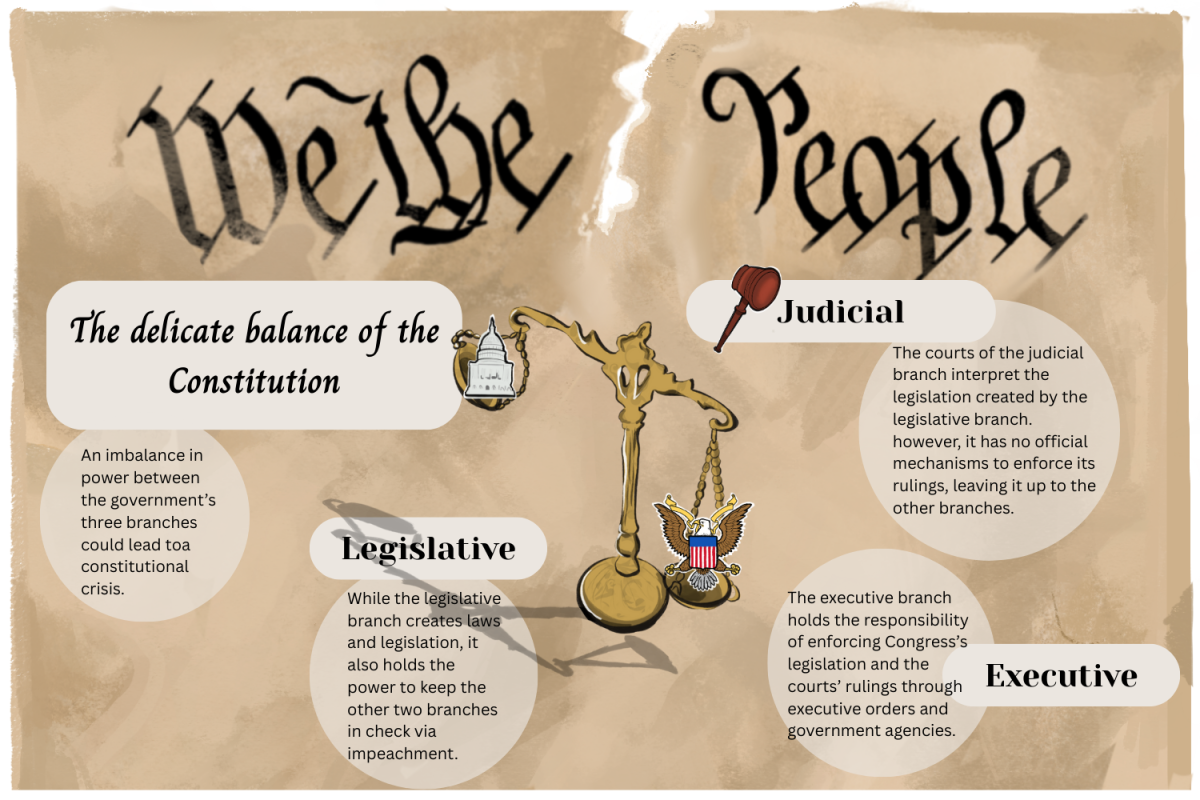

Most banks in the U.S. act as intermediaries, receiving money from deposits or by issuing stock to provide loans and other financial services

April 10, 2023

The power of banks in the U.S. economy has grown abundantly clear as recent collapses have sent shockwaves through the banking sector, leaving devastating impacts on depositors and the economy as a whole. Most banks in the U.S. act as intermediaries, receiving money from deposits or by issuing stock to provide loans and other financial services. By employing fractional reserve banking, a system that requires certain percentages of deposits to be physically available for withdrawal, banks facilitate the flow of money in the economy and uphold regulations to maintain the economy’s stability.

“Banks essentially take the money which people deposit in their accounts and lend them to those who need the money,” UC Berkeley finance professor Terrance Hendershott said. “They then give interest on the depositors’ money by investing in places.”

Issues in this cycle arise in cases where the value of loans and stocks fall, causing a decline in asset value and insufficient funds to pay depositors. In turn, extreme and unpredicted influxes in withdrawals, or bank runs happen, where depositors rush to withdraw money and the amount of money being requested exceeds the amount the bank is able to distribute. Such was the case for Silicon Valley Bank, a midsize California-based bank that suffered the second largest bank collapse in U.S. history on March 10, 2023.

“It was frightening to see how everyone was blindsided by it,” senior Angela Chung said. “I have an account in SVB and woke up to see that all my money I had earned was gone — it was an eye-opening experience.”

The collapse was due in part to a lack of diversity in investments, particularly in the technology sector. As a bank catering specifically to the California Bay Area’s tech industry, Silicon Valley Bank’s clientbase was composed mainly of venture-backed tech startups and experienced rapid growth due to the success of tech companies during the pandemic. Handling a huge amount of uninsured deposits, as well as investing in long-term treasury and mortgage assets that lost market value as interest rates went up also contributed to the risks that ultimately amplified the impacts of its collapse. These factors, among others, intensified public doubt in the bank’s long-term financial solvency, or ability to meet financial responsibilities. These doubts came to a head in the proceeding collapse and seizure by the California Department of Financial Protection and Innovation.

“We add layers of regulators to try to stop the banks from taking too much risk, but you see the wreckage of that idea all around you,” Stanford University economics professor John Cochrane said. “In 2008, and again this year, regulators didn’t see even pretty simple risks building up.”

One of the most immediate effects of this bank collapse was the disruption of the financial services that the bank provides to its clients. Many of the world’s leading technology companies relied on Silicon Valley Bank for essential financial services such as lending, cash management and investment banking. Collapses not only weaken the economy by eroding trust in the financial system and disrupting financial services, but can also cause a ripple effect known as contagion wherein other banks collapse under customer doubt triggered by initial failures of the first bank. In the wake of Silicon Valley Bank’s crisis, others like Signature Bank, Silvergate Bank and First Republic have collapsed or are at risk of bankruptcy after suffering massive losses.

“Silicon Valley Bank overinvested and lost all the money of the depositors,” Hendershott said. “But luckily, the government was there to back them up, making sure that essentially all the money lost would be circulated.”

On March 12, the federal government issued a statement announcing that they would step in to protect all of Silicon Valley Bank’s depositors. SVB was bought out by the other bank, and eventually all the money which was considered gone was restored. The money was transferred to other banks so that people could access their money and on March 17 the SVB officially filed for bankruptcy. The Federal Deposit Insurance Corporation took aggressive action, and technology which had benefited SVB lost momentum as a result of higher borrowing costs.

“A cursory look at the bank’s books would easily have revealed that the bank was vulnerable to higher interest rates,” Cochrane said. “Just why our vast regulatory apparatus was unable to see this elephant in the room is a good question.”