Housing prices rise in Silicon Valley

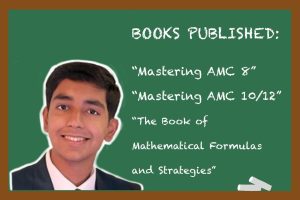

Graphic illustrations by Tanika Anbu

Rising housing prices in Silicon Valley have forced many renters out of their homes, contributing to declining enrollment in FUHSD.

December 12, 2022

Skyrocketing housing prices and declining home listings in Silicon Valley have forced many renters out of their homes and left potential homeowners lost in a market of unattainable residences. Increasing prices and older resident demographics have taken the future of buying property out of the picture for many. Moreover, this housing crisis has significantly contributed to issues like declining enrollment in FUHSD, while disproportionately affecting lower-income and blue-collar workers looking to move into the coveted location.

“Silicon Valley has a lot of tech companies so tech workers are willing to pay for higher housing prices,” Cupertino Vice Mayor Liang-Fang Chao said.

The San Jose metro area has seen a 20% decrease in house listings on the market while housing prices have climbed by 7.5%. This issue can be attributed to declining availability during a time of peak demand. With the tech industry at the epicenter of Silicon Valley, the surrounding area becomes an agglomeration of individuals working such jobs, heightening its allure. The rapid employment boom in the industry has subsequently increased the population within this condensed area, escalating housing demand.

“Here you’re paying for the land,” said junior Vipra Bindal, an intern for real estate business Pacific Point Group. “The value of the property mostly comes from the land that it is on because of what it is in proximity to, rather than the actual structure.”

Yet, leveraged by the varying property tax per house, homeowners are more inclined to stay in their current residence. Under Proposition 13, long-time residents enjoy the luxury of paying the property tax of their home’s initial selling price rather than that of the contemporary cost. If older homeowners were to purchase property elsewhere, they would have to pay the tax of the current price, a less appealing scenario as homes have significantly appreciated in value, rendering the property tax much greater. Although meant to benefit older residents, this proposition inadvertently decreases supply on the market.

“Many Bay Area residents who retire do not choose to sell their houses because they understand the worth of their house,” English teacher Evyenia Ene said.

The high ranked school districts within Silicon Valley have been a constant driving factor for eager families looking to move in. The presence of competitive schools have significantly increased the allure of the area and overall demand. However, as seen in recent years, housing near FUHSD high schools has remained stagnant. As the age of homeowners increases, many of their children graduate, yet they choose to stay in their homes. This can be linked to declining enrollment across FUHSD. Younger families are not able to move in, meaning less students are able to attend schools in the area.

While the majority of the Cupertino population owns their own property, 39% of households in Cupertino are still renting. However, ever since the pandemic in 2020, rent prices have been plummeting because many tech workers have transitioned into working remotely and have moved to cheaper areas to reside. From 2019 to 2021, Santa Clara renting prices have decreased by 5.8%. Although the pandemic has impacted the renting market in the Bay Area, it is slowly climbing up to pre-pandemic prices since many people still strive to live in Silicon Valley given its award-winning school districts and tech opportunities.

“As demand grows, supply stays the same, so the prices increase,” Bindal said.

In light of rising mortgages in the post-pandemic world, individuals are unable to purchase homes. In order to wind down the record-high inflation, the federal government has increased interest rates, thus boosting mortgage rates drastically. For instance, the average 30-year mortgage at the beginning of 2022 was around 3% but has now risen to an average of 7%. It is increasingly difficult for individuals to pay off mortgage loans, barring them from being able to purchase property and heightening unaffordability within Silicon Valley. As higher interest rates were implemented to decelerate the economy, supply within the market lessened, thus stunting the overall growth of the market.

With the large presence of tech workers, areas tend to become increasingly affluent, creating a baseline of incredibly high prices. This not only discourages affordable housing but also prices out families. According to a study done by the San Jose Spotlight in July 2022, sellers often closed deals at about 5.6% over the asking price.

Those with disposable income have the ability to comply with excessive financial demands, inadvertently encouraging high rent or selling prices. Yet, blue-collar and low-income workers are disproportionately disadvantaged by the housing crisis. With the wage gap continuing to widen, those on the opposite side of the socioeconomic spectrum have a difficult time integrating into these areas. Most of these individuals work service jobs in the tech sector, meaning they may have lost jobs during the pandemic and weren’t able to stabilize their income. With housing prices on the rise, lower-income workers may not be able to keep up, pricing them out of the area and unable to find homes. In fact, the same cities that are housing the wealthy are seeing a surge in homelessness.

“Inflation worsens the widening income disparity since every salaried worker essentially takes a pay cut while investors multiply their fortune.” Chao said.