Politicians must stay above the influence of private interest

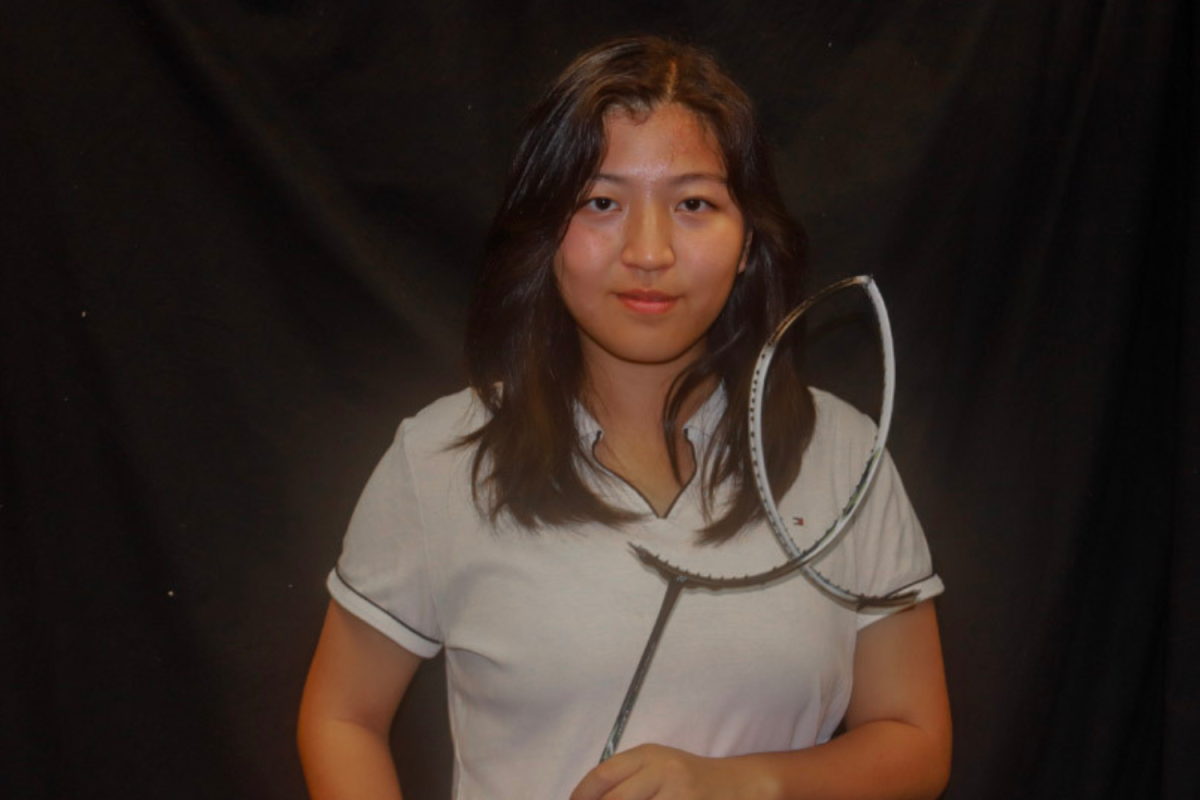

Graphic illustration by Youqi Huang

Companies initiate a runaway cycle of attractive benefit that draws politicians toward the private sector when they pay politicians inflated speaking fees.

February 3, 2021

Janet Yellen, the first woman to chair America’s Federal Reserve, was sworn in as the nation’s first female Treasury Secretary on Jan. 25. However, Yellen’s financial disclosures, released through the customary confirmation process for all cabinet nominees, revealed that she made $7.2 million through speaking engagements in the two years after she left her position as the head of the Federal Reserve in 2018, casting a pall over her historic achievement.

“I thought Yellen’s nomination was a win, overall,” sophomore and Intersections Treasurer and Secretary Riya Abiram said. “It’s definitely historic and it’s good that she’s experienced in the field she’s going to be serving in. However, I don’t think she was the best choice because I think we should avoid entangling corporations and the government to the best of our ability, because corporations don’t exactly have the people’s interests at heart.”

Yellen’s shocking profits are just one example of America’s decreasing ability to keep politics free of corporate influence, raising concerns over the lucrative transitions between public and private sectors for current and ex-politicians.

Yellen’s experience chairing the Federal Reserve distinguished her as one of the foremost economic minds in the U.S., so it is no surprise that large corporations would break the bank to hear her advice. After she was dismissed from the Federal Reserve during former president Donald Trump’s administration, Yellen spoke at financial institutions such as Citi and large corporations like Google and Salesforce.

She was unable to disclose the content she covered at multiple corporate engagements during the two years after she left the Federal Reserve because she conducted them as question-and-answer sessions with no prepared remarks. These factors, when combined with her exorbitant rates, have led some to speculate that she could have been paid to share insider information or advice on exploiting legislative loopholes.

Corporate influence exerts itself through money

Companies in the private sector benefit when they inflate the value of politicians who come to give speeches: it flatters the speaker, and organizations look influential when they invite valuable people. The practice initiates a runaway cycle of attractive benefits that draws other politicians toward the private sector, instead of continuing in government positions or moving toward academia, for example.

“The key word here is access,” government teacher David Pugh said. “Money gives you access to these very important people with many connections and incentivizes them to lend you their ear. This proximity is also good for your image.”

The Democratic Party has been forgiving of Yellen, pointing to her track record and strict attitude toward financial institutions as the head of the Federal Reserve. Combined with the fairly common nature of politicians giving speeches and receiving exorbitant speaking fees in return, Yellen’s incident was largely swept under the rug by her party and the American public alike.

Her case, however, points to a larger problem in American politics — that politicians can make millions a year giving speeches, and arrangements like this are commonplace enough that they can be dismissed as industry practice among the private and political sectors.

For an ordinary citizen, making $7.2 million over two years as a public speaker is difficult to comprehend. There’s no doubt that Yellen and other politicians have gained insights in the political sphere that could be unique to their experiences and of great value to their clients. However, the exaggerated price tags companies put on politicians’ speeches only increases doubt from the general public on the nature of information exchanged. Once politicians who were collecting million dollar checks return to office to regulate the same companies they advised, their constituents have to worry about the extent to which money and corporate interest can influence policy.

American politics’ “Revolving Door”

There is good reason for Americans to be concerned about the relationship between the public and private sectors when the transition from one to the other can be so seamless, it is said that the two are connected by a revolving door. While the revolving door is mainly used in American politics to describe politicians who become lobbyists or lobbyists who become politicians, the undeniable connection between business and politics is clear in the astronomical speaking fees companies are willing to pay politicians and the ease with which ex-politicians can transition into roles as consultants or advisors at large corporations.

“As a hypothetical example, say you’re the chair of the Securities and Exchange Commission,” Pugh said. “You know that, after you leave this job, you could walk into private industry and make a ton more than what you’re earning right now. So, are you going to do anything as a regulator that could upset your future employer?”

Ex-politicians make for particularly effective lobbyists because of their connections with their colleagues, who may still be working in the same branch of government they’re lobbying. This gives them an advantage when representing interest groups. Though not as common on the national level, politicians can even transition from lobbying back to politics, making it difficult for constituents to know where politicians’ interests lie or believe them when they proclaim it.

“One of the biggest problems behind the revolving door is that it can reduce the desire of a politically-appointed head of a regulatory agency to act as a watchdog,” Pugh said. “The situation is like asking a wolf to guard the chickens.”

How politicians can win their constituents’ trust

Politicians who know they will re-enter or plan on re-entering the public sector should avoid associating with or taking on work in industries that can cast this shadow of doubt on them to begin with. Whether it be Yellen’s relatively benign speaking engagements or Secretary of State nominee Anthony Blinken’s work consulting prominent private equity firm Blackstone, the ordinary American citizen doesn’t have the power to discern whether politicians are doing anything illegal or unethical while in the private sector. Once politicians working in the private sector assume office again, their constituents can only wonder if they are staying above the influence of the companies they once worked with.

“Especially when you leave political office and return, what’s really important is transparency,” Abiram said. “You need to be able to disclose everything that you did in your past so that the people whose lives you’re affecting can understand where you’re coming from and believe that you don’t have ulterior motives.”

If politicians choose to continue working in industries that could cast doubts on their integrity, whether out of malicious intent or not, they prey on the public’s inability to hold them accountable. It may seem unfair to be so restrictive toward politicians who could just as well be making honest money contributing their insights on economic issues as they could be disclosing information on regulatory loopholes. However, as the people their constituents depend on, they can stand to be fully transparent once or twice and experience the financial loss of a lucrative money-making prospect not taken.

At the moment, disqualifying people from reentering the political sphere because they worked with large corporations in the private sector, as some progressives have pushed Biden to do with his Cabinet, would reduce the candidate pool for these positions by too much. Proponents of these so-called purity tests, however, argue that the new administration could just as easily look toward academia as Wall Street for qualified appointees.

Purity tests: stumbling blocks in the diversification of higher office

According to Investopedia, well-performing stock brokers, analysts and fund managers on Wall Street easily make over $100,000 a year, and the variability in compensation due to factors such as commission means some bring home more than a million dollars annually. The top 10% of lobbyists made more than $166,400 a year in 2010. In comparison to the $97,156 earned by the average non-tenure track faculty in Public Administration and Social Services departments — who make up 58% of all appointments, according to American Association of University Professors — the fiscal advantages and allure of a career in the private sector or as a lobbyist are clear to aspiring politicians and ex-politicians.

More often than not, it is politicians from marginalized backgrounds, crucial to the diversity of our government, who feel the pressure to take on these positions, out of financial need or a desire to build wealth for their families now that they are in a position to do so. Unlike white politicians, who are more likely to come from moneyed backgrounds, for example, politicians of color often don’t have as much luxury to pick and choose what jobs they’d like to take on.

What constituents can do to hold politicians accountable

As constituents, we can raise the bar going forward and redefine what is acceptable for politicians looking to enter the private sector. Politicians have the responsibility of taking these words to heart and behaving ethically when the people they govern can’t hold them accountable.

“Even in cases like Yellen’s, where she was nominated to her position by other politicians instead of being elected into office, we still have the power to hold politicians accountable,” Abiram said. “If there was a situation where the person appointed was harming the country, it would be important to hold the person who appointed them accountable when it comes time for re-election.”

When we no longer accept million-dollar speaking fees and the revolving door as unfortunate necessities, we can make bold reforms necessary to diminish corporate influence in politics and create a government that listens to people rather than money.