Removing the politics behind periods: California bill removes sales tax for menstrual products and diapers

April 17, 2020

California Senate Bill 92 (SB 92) went into effect on Jan. 1, 2020, temporarily removing the sales tax on menstrual products and diapers. Passed in June 2019, the law made California one of 13 states to exempt hygiene products, such as pads and tampons, from a sales tax. However, SB 92 expires on Dec. 31, 2021.

SB 92 specifically states that “diapers for infants, toddlers, and children, and menstrual hygiene products, defined as tampons, specified sanitary napkins, menstrual sponges, and menstrual cups” are exempt from sales taxes. The law intends to combat obstacles to acquiring these essential products that have a 66-cent-per-box “tampon tax,” which can be an issue for many because women typically menstruate for around 40 years of their lives and these costs can add up. For instance, junior Amy Sun estimates that she spends around $50 to $70 per year on menstrual products.

“I may not be affected as much since I am not the one in my family who spends money on these products, but I imagine that others who do not have the luxury of not having to worry about spending would suffer because there is nothing they can do about it, as these products are necessities,” Sun said.

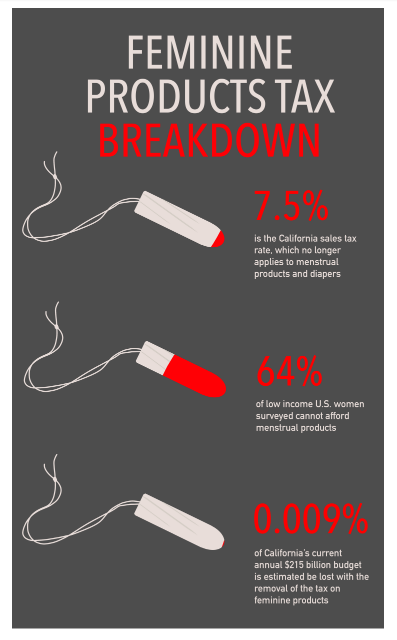

Menstrual products are a basic human need for women, but a 2018 Reuters study of low-income women found that 64 percent of them were unable to afford these products during the past year. This problem negatively affects a woman’s ability to work and participate in life, exacerbating existing issues of inequity.

“The tax may not be too notable for those who live in affluent areas, but those who are impoverished or homeless would be greatly affected by it,” junior Ingrid Lee said. “Women cannot stop menstruation without the use of such products as birth control, which is costly in itself, so they are hindered by the additional cost on these products.”

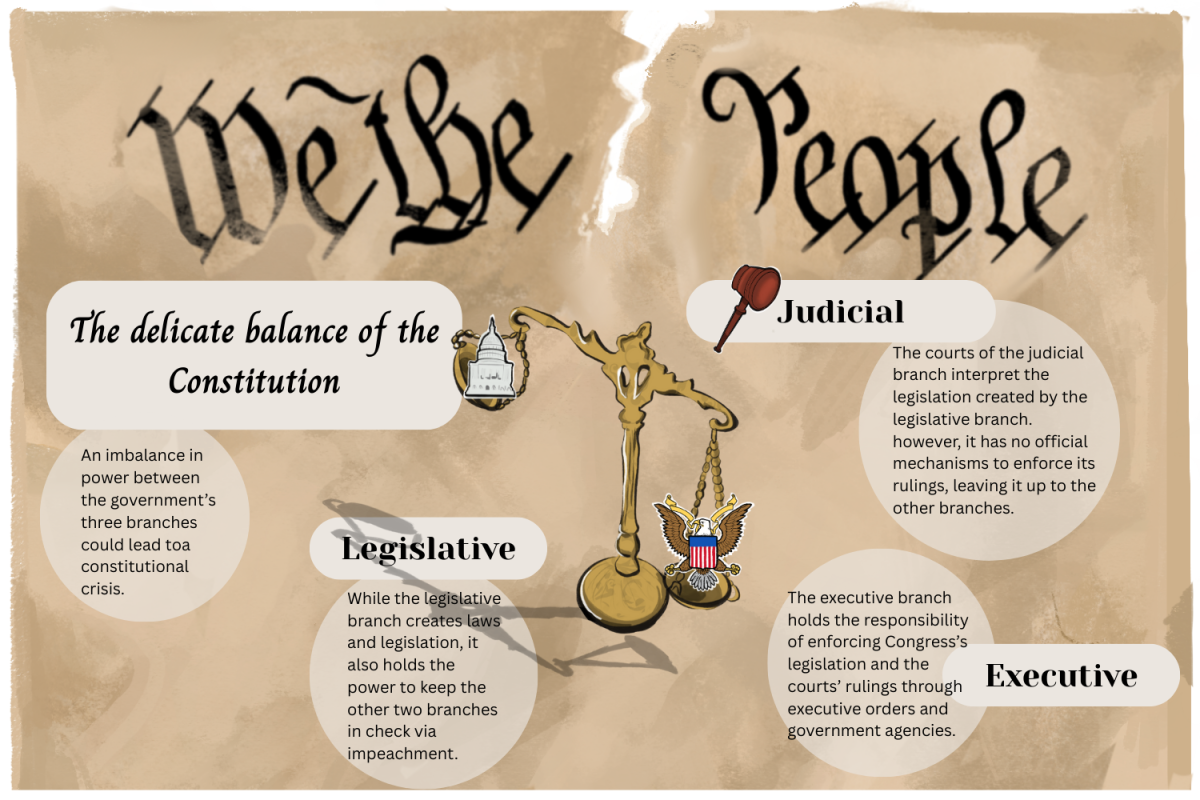

Supporters cite the fact that medically necessary items are not taxed as a reason why menstrual products and diapers should not be taxed. For instance, Viagra, medicated condoms and yeast infection medicine are considered drugs and are not taxed. Furthermore, if an adult suffers from incontinence and receives a prescription, their diapers will not be taxed. Although all infants are inherently incontinent, their diapers still had a tax before this bill was passed.

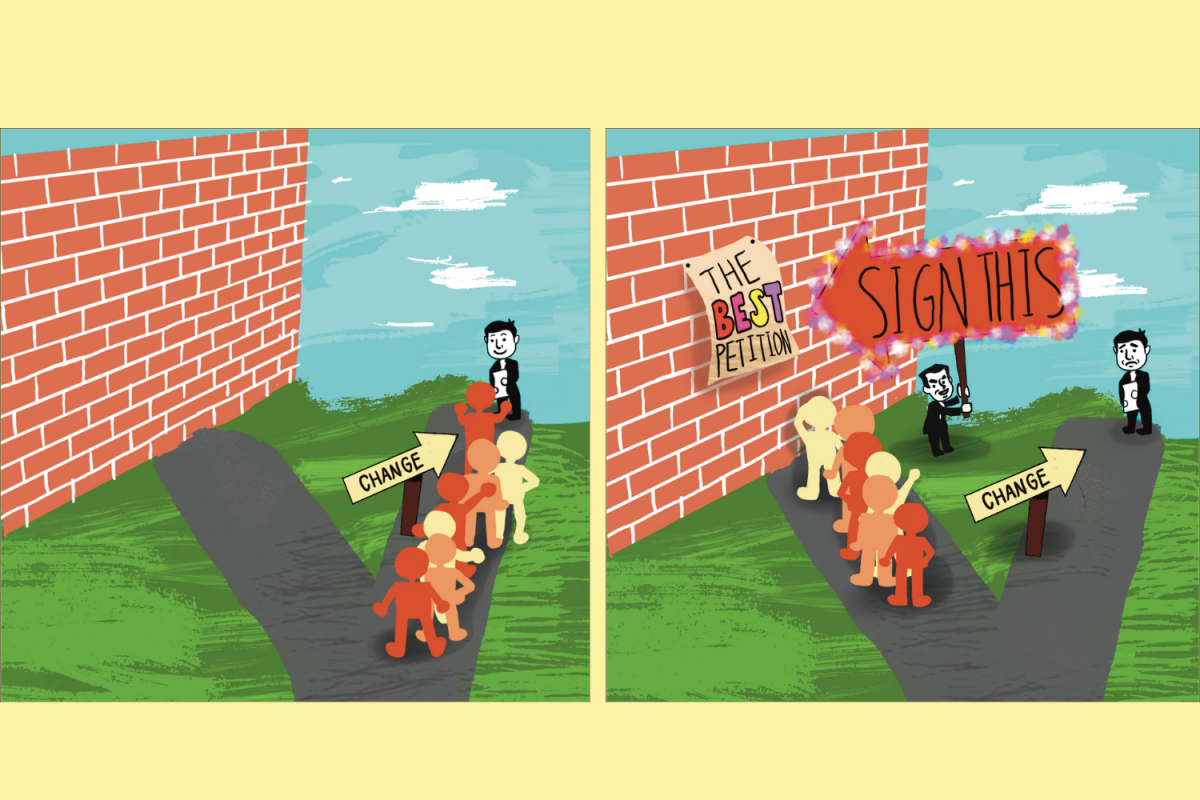

However, those who argue against removing the tampon tax are concerned about its effects on the state budget. With the removal of the 7.5 percent sales tax, California is estimated to lose approximately $20 million, which is approximately 0.009 percent of its current $215 billion annual budget. This could impact the state’s ability to fund public programs and lead to the increase of other taxes to make up for the loss. In addition, opening the door for tax exemptions could create confusion on what items qualify.

Although eliminating taxes on diapers and menstrual products has a negative effect on the state budget, the policy helps reduce the inequality that women face. Because sales tax removal is temporary and only lasts for two years, activists will have to continue to push for change. Meanwhile, customers who have been charged a sales tax on these products since the beginning of this year can request a refund from the retailer by bringing their receipt and a copy of the notice from the California Department of Tax and Fee administration.