California became the 26th state in the union to mandate a semester-long personal finance course for public high school students on June 27. The decision is reflected in Assembly Bill 2927, a collaboration between California State Senate President Mike McGuire and California Governor Gavin Newsom, with Next Gen Personal Finance Mission 2030 sponsoring this endeavor as well.

The program encourages students to learn financial literacy responsibility, ensuring that future alumni will be able to maintain secure retirement accounts and emergency savings. California plans to integrate the additional curriculum in two phases: a comprehensive financial literacy curriculum during the 2027-28 school year and then a mandatory graduation requirement starting in the 2030-31 school year.

“This course will help students navigate adult financial responsibility that have otherwise been largely unsupported in public schools up to this point,” FUHSD Superintendent Graham Clark said.

As students advance toward adulthood, financial literacy classes will serve as a way for them to learn about the many financial responsibilities critical to sustaining their financial stability. These responsibilities include maintaining credit, borrowing loans, using credit cards and preparing for retirement.

According to a 2022 Financial Education Report by NGPF, only 25% of high school students have access to financial literacy classes. Although a nationwide survey by the National Endowment for Financial Education found that nearly 90% of adults surveyed are in support of a financial literacy class, only half of the states have established this graduation requirement.

When implemented at Lynbrook, this new curriculum will serve as a refresher for those who have already taken the financial literacy course offered at Joaquin Miller Middle School. Ingrid Lu, the financial literacy teacher at Miller, said in an interview that while Miller’s course does cover many advanced financial literacy topics in great depth, a high school course may be more applicable to students.

“High schoolers have much more freedom and independence,” Lu said. “They have a job, they are driving and they will need to save up for college, so learning about personal finance is more real to them.”

Lu has been using NGPF’s free resources for six years to create a comprehensive financial literacy course for middle school students. Based on NGPF’s financial literacy curriculum, she created a class that includes both teacher-led lessons and interactive student-led discussions and presentations.

“When I was trying to find materials for this class, I called around to different districts, but didn’t receive that much support,” Lu said.

Currently, the district is in the preliminary stages of curriculum development, with FUHSD staff and teachers working to prepare policy proposals for a board meeting later in the school year. This task force will be discussing the FUHSD-specific timeline for the implementation of this law and the development of a new curriculum. Some key logistics that are under consideration include the general content of the curriculum and how it will be presented to high school students.

“It’ll be interesting to see what kinds of solutions we come up with over the course of this year,” Clark said.

The state of Utah had a similar discussion back in 2003, when a bill establishing a financial literacy graduation requirement was signed into law. The following year, a semester-long financial literacy class was required starting with the Class of 2008. According to a study directed by the state auditor and state treasurer in 2018, high school graduates who took the course scored better on average on a financial literacy test than those who had not taken the course.

However, this same study also points out areas of improvement, such as the consistency of the curriculum. As FUHSD moves closer to officially administering its financial literacy program, careful review and consideration of previous states’ successes and challenges could guide this program to be as successful as possible.

Similarly, concerns over possible bias have come up in the Lynbrook community as the financial literacy curriculum is being standardized. Some have pointed out that there are multiple ways to approach financial literacy. Critics claim that the national and state standards for financial literacy mainly focus on personal financial responsibility, completely ignoring the systemic inequity that also influences personal finance.

“I think that teachers need to sign a fiduciary which states that they cannot be influenced by any companies or sell any product in a public school,” Lu said. “As long as financial literacy teachers diversify and talk about the benefits and drawbacks of different financial lifestyles, teachers can avoid being personally drawn into the class.”

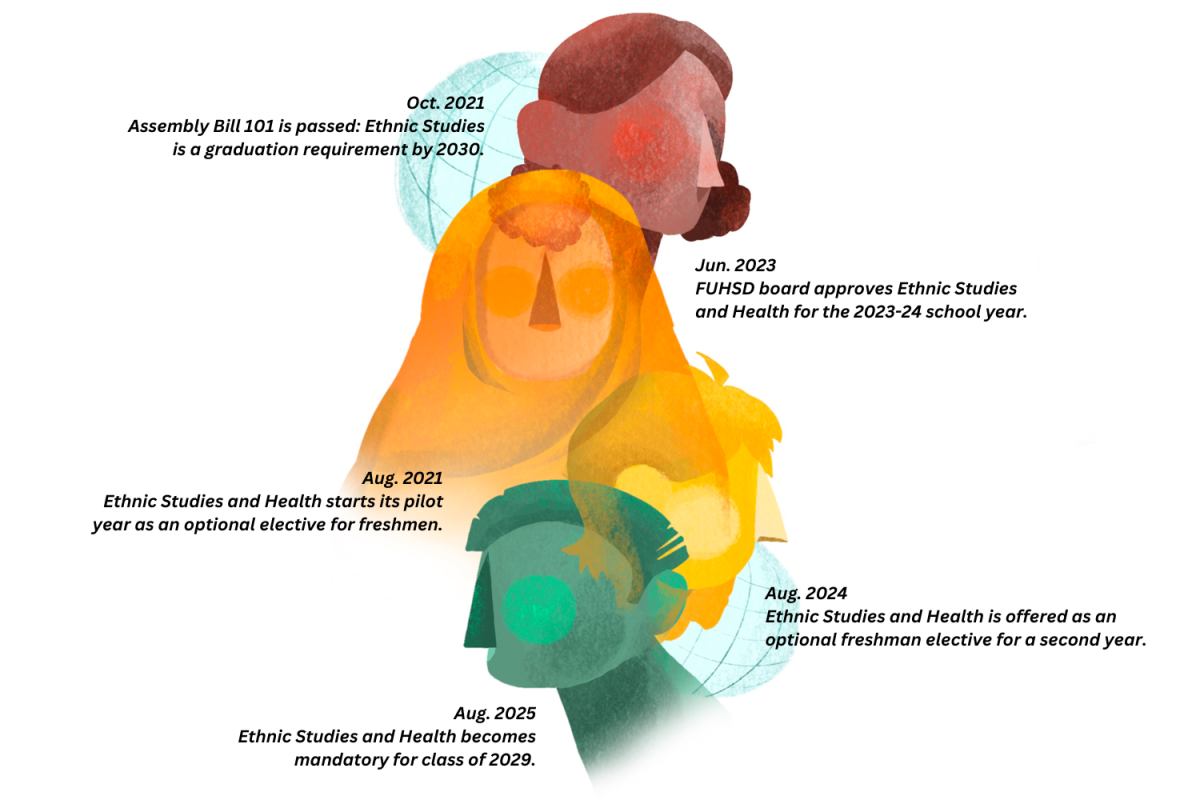

Additionally, the new course requirement would limit the number of electives each student could take. In particular, AB 2927 specifically prohibits the course from being incorporated into existing curriculum, and would need to be a standalone semester class, in addition to other existing requirements such as economics. The further limitation of elective choice echoes community concerns when the district previously discussed mandating freshmen to take the Health and Ethnic Studies course.

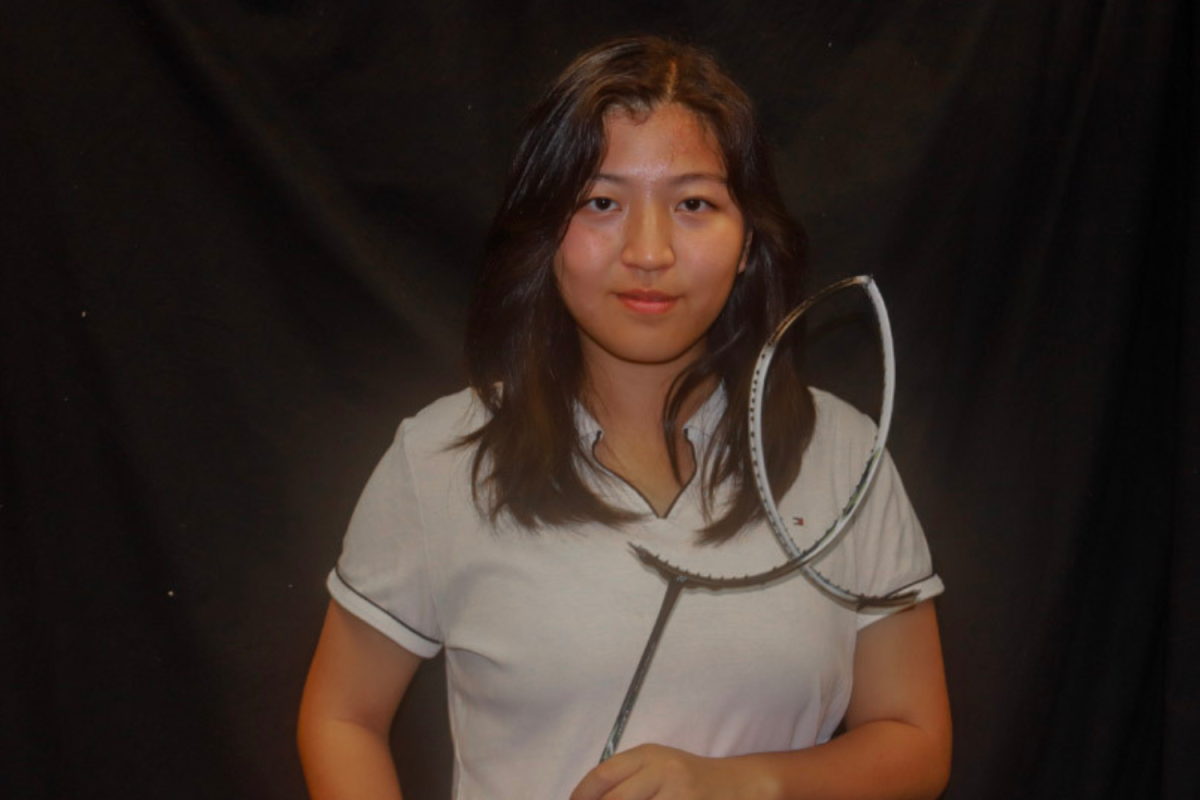

“In high school, there is very limited time and course slots for all the classes a student wants to take,” sophomore Shannon Zhang said. “Some students would rather take an AP or honors course for college than financial literacy, especially if they have already taken similar courses. That’s just something to take into consideration.”

In light of these concerns, lawmakers and educators are taking the time necessary to fine-tune the curriculum in the hopes of advancing a more financially responsible student body at Lynbrook.

“Students need to understand their financial situation and how to navigate it,” senior Sagar Bhatia said. “It is a basic life skill that most students should be comfortable with, especially after graduating high school.”