Texas court ruling jeopardizes Obamacare reforms

Court ruling in Texas jeopardizes previously established reforms by Obamacare.

February 1, 2019

Pregnancy. Paralysis. Diabetes.

These three conditions have little in common, except that each of them could have caused a patient to be declined medical insurance before the Affordable Care Act (ACA), commonly known as Obamacare, came into effect in 2014.

Enacted during the Obama administration, the healthcare reform act aimed to improve the affordability and accessibility of health insurance. The program was jeopardized on Dec. 14, 2018, when a Texas court judge declared the law unconstitutional and thus invalid. Though the ACA cannot be repealed until the appeals process is complete, and although the ruling may be overturned, it is important to look at the legality of the law and how a potential repeal would affect the healthcare market.

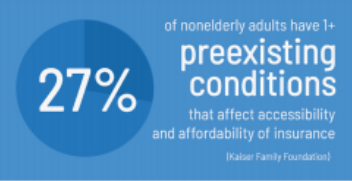

Before the ACA was passed, the U.S. healthcare system was marked by shortcomings. Many could not afford to purchase healthcare, including low-income people, young adults and those with pre-existing conditions who faced higher premiums. These uninsured people ran the risk of financial ruin if they had a medical emergency — such as a broken limb, a car accident or a cancer diagnosis — that would not be subsidized. For this reason, medical costs were the leading cause of personal bankruptcies.

The ACA aimed to resolve this problem by making healthcare more affordable and accessible to at-risk populations. However, many questioned the ethics and legality of a particularly controversial provision known as the individual mandate, which required most Americans to purchase a basic healthcare plan or pay a fine.

This meant that healthy people who otherwise would have little use for health insurance were forced to buy it. Legislators framed it as such because when all patients purchase healthcare, overall premiums decrease; since healthy patients do not incur as much in medical fees as others, increasing the portion of healthy patients means that insurers have to spend less per patient, thus improving overall affordability. However, the passage of this law raised an important question: is it legal for the government to force citizens to make a purchase, even when it might be to their financial detriment to do so?

In the 2014 case National Federation of Independent Business v. Sebelius, the Supreme Court did, in fact, deem it legal, voting 5-4 to uphold the mandate as an exercise of Congress’s taxation power; the fine for not buying health insurance, it ruled, was a legal mode of tax collection. Still, pressure from opponents built until the Republican-controlled Congress in 2017 voted to nullify the mandate, setting the tax to zero dollars. Since then, the rest of the ACA has remained in effect, simply without enforcing the requirement to buy healthcare.

This created a problem for insurance companies due to another, more popular, provision of the ACA known as the guaranteed issue clause, which outlawed private insurers charging more or declining coverage to patients with pre-existing conditions. When Congress voted to stop enforcing the individual mandate, many healthy people terminated their plans. Insurers were still required to cover patients with pre-existing conditions who spend more in medical bills, thus dramatically increasing the average cost per patient and forcing insurers to charge more overall.

In short, the individual mandate was meant to work in conjunction with the guaranteed issue clause. The individual mandate decreased the average cost per patient for insurers, offsetting the increased costs of covering patients with pre-existing conditions.

This was the basis of Texas Judge O’Connor’s ruling in December. Since National Federation of Independent Business v. Sebelius founded the ACA’s constitutionality on the basis of being an exercise of Congress’s taxation power, and since the individual mandate was no longer generating any tax revenue, it could no longer be considered a tax and was therefore unconstitutional. Judge O’Connor argued that since the rest of the ACA, especially the guaranteed issue clause, was structured around the premise of the individual mandate, the act must be struck down as a whole.

However, many legal scholars disagree with the basis of the ruling, including Professor Michael McConnell, former Tenth Circuit Court judge and director of the Constitutional Law Center at Stanford University. He argues that since the individual mandate tax is no longer being enforced, it functions as a recommendation rather than a law, and therefore cannot be considered unconstitutional.

“The district court confused a congressional decision to render the mandate toothless [ineffective] with unconstitutionality,” McConnell said. “A zero percent tax is not unconstitutional; it is just toothless. The reason Congress deemed the rest of the statute inseparable from the mandate was a matter of economic reality, not of form. It was Congress’s decision to reduce the rate to zero.”

The decision was met with severe pushback from Democratic leaders, who promised to appeal it and fight to preserve the rest of the ACA. Those who disagree with the basis of the ruling, including Professor McConnell, foresee a quick end to O’Connor’s ruling.

“I think it likely that the Fifth Circuit Court of Appeals will reverse the district court’s decision, and that the Supreme Court will deny review,” McConnell said.

In any case, the ACA will stay in effect for at least the short term, which is a relief to many. Despite the contested legality of the ACA, it remains a popular and positive reform; in fact, public approval for the ACA as a whole has increased since its passing in 2010, largely due to the protections it provides to those who otherwise would not have access to healthcare. These greatly contributed to the decline of personal bankruptcy filings by half from 2010 to 2016.

The guaranteed issue clause was one of the most well-known provisions, but the ACA offers several other protections to those at risk of losing coverage. It expanded both Medicaid and Medicare, providing aid to those who are unable to afford healthcare themselves and reducing the medical costs for the elderly. Additionally, under the ACA, insurance plans cover preventative care, including screenings and vaccinations; businesses with over fifty employees are required to provide insurance plans to employees who work thirty-hour weeks or more.

One of these provisions affects the Lynbrook population in particular: the requirement that people under the age of 26 be covered under their parents’ plans. Repealing the ACA would leave many young adults struggling with the sudden financial burdens of adulthood with the added challenge of paying for often costly medical insurance. The problem is compounded when a young adult with a pre-existing condition applies to private insurers who are likely to deny coverage or raise rates. These added costs inhibit economic freedom in young adults; the increased price of living can discourage young adults from taking out student loans or going to university before entering the workforce.

“Some of my friends’ families have a lot of medical bills, and it’s very stressful for them when they don’t know how they can pay for college,” said Samiksha Patil, vice president of the Health Education Association of Lynbrook. “Obamacare is a step in the right direction.”

Though these reforms come at costs to insurers, high-income taxpayers and individuals who would otherwise not purchase healthcare plans, they also protect several large groups of Americans who were not able to protect their own health previously. This is the tradeoff at the cornerstone of Obama’s reforms: that while the individual mandate has its downsides, it is better for some to be forced to purchase healthcare than for others to be forced to live without it. The ACA was built on the philosophy that healthcare is a right, not a privilege.

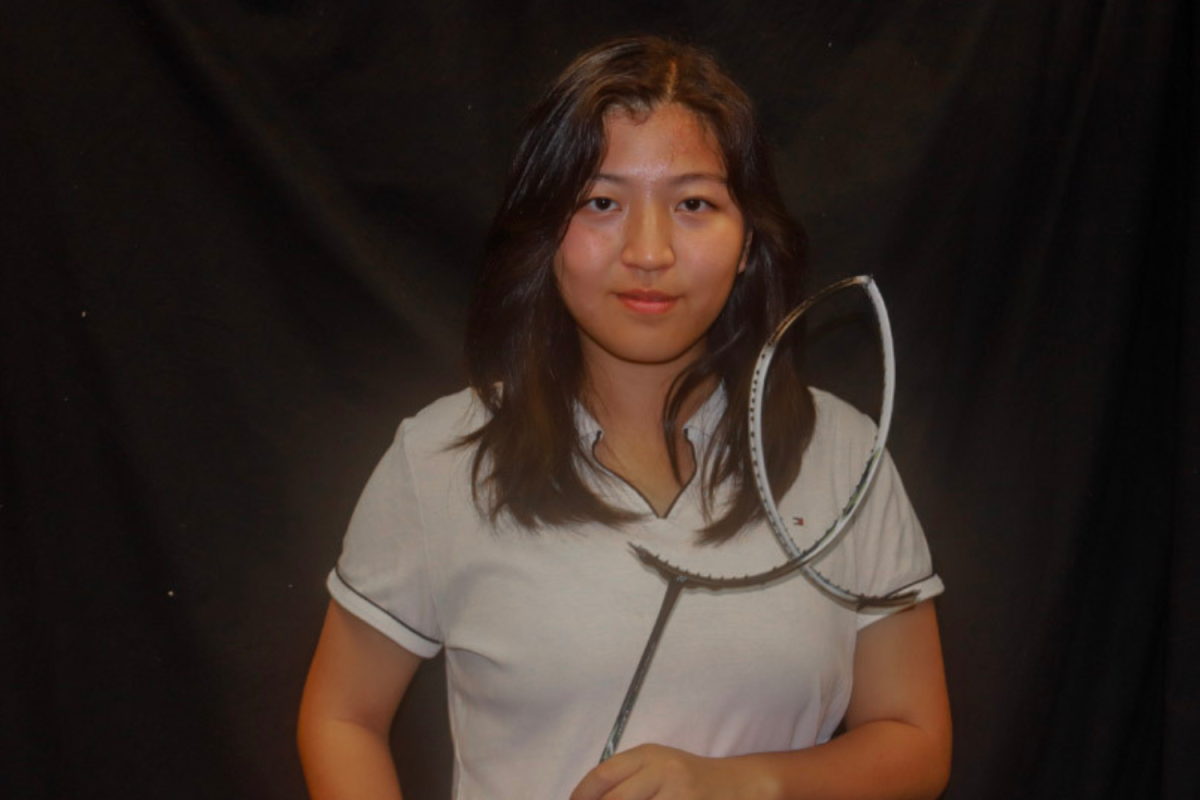

“Healthcare is a basic necessity that everyone should get to have,” said Heather Kong, vice president of Pre-Medical club. “If somebody is sick and they need money for treatment, there should be a policy in place to help them.”

The Declaration of Independence proclaims the natural right of all people to life, liberty and the pursuit of happiness, and the private insurance system has failed to adequately protect the lives of millions of Americans. The ACA is the closest legislators have come to remedying this problem. Overturning it would be to deny millions a right they were promised was unalienable.

Check out our exclusive interviews with Stanford law professors Michelle Mello and Michael McConnell on the legal basis of the ruling and the ACA here: https://lhsepic.com/4427/opinion/obama-care-qa-with-stanford-professors-michelle-mello-and-michael-mcconnell/