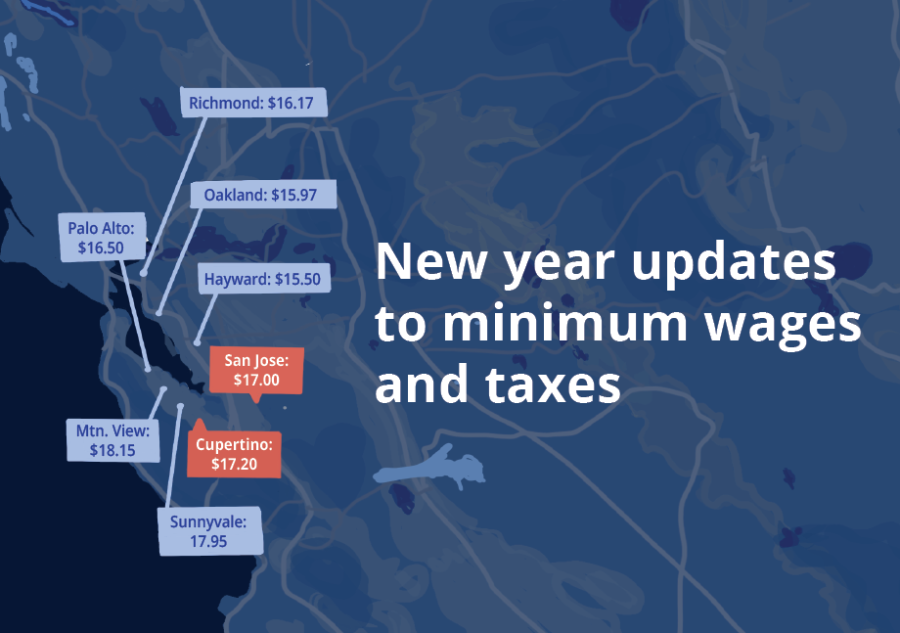

New year updates to minimum wages and taxes

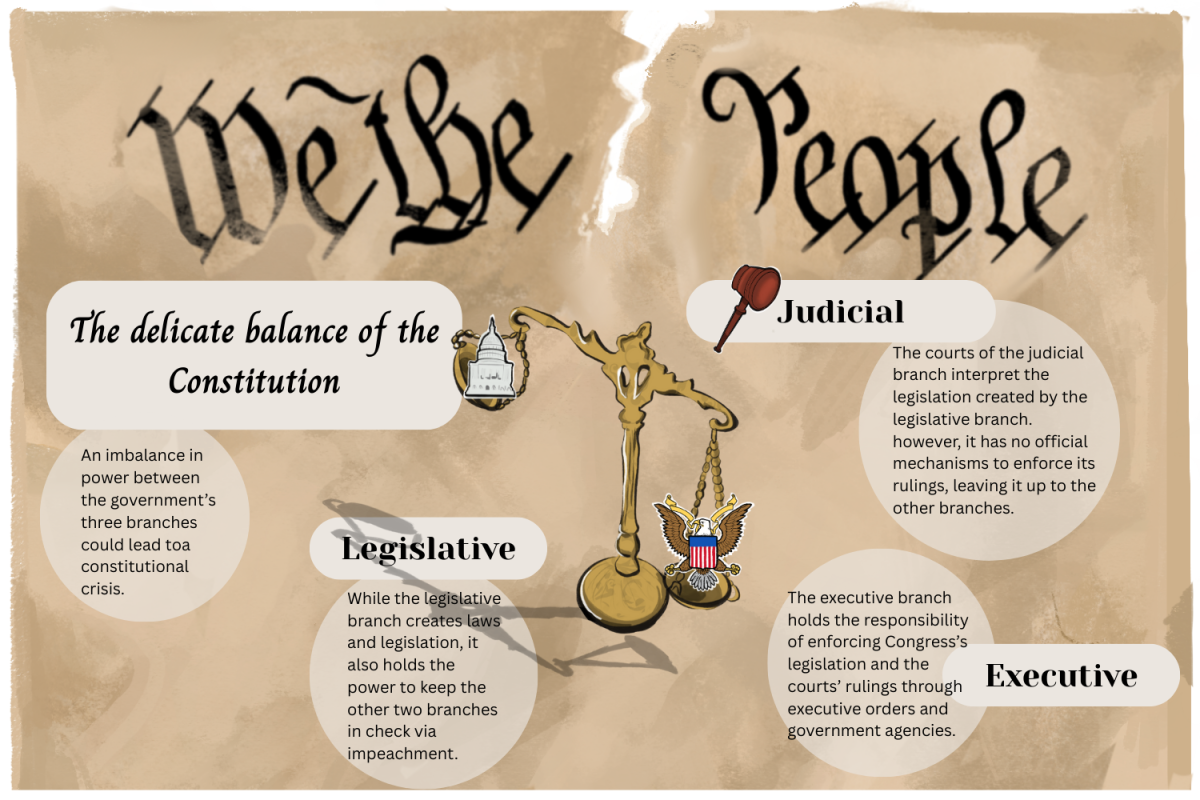

Graphic illustration by Maple Leung

Minimum wages across the Bay Area increased after the enactment of Senate Bill Three.

February 6, 2023

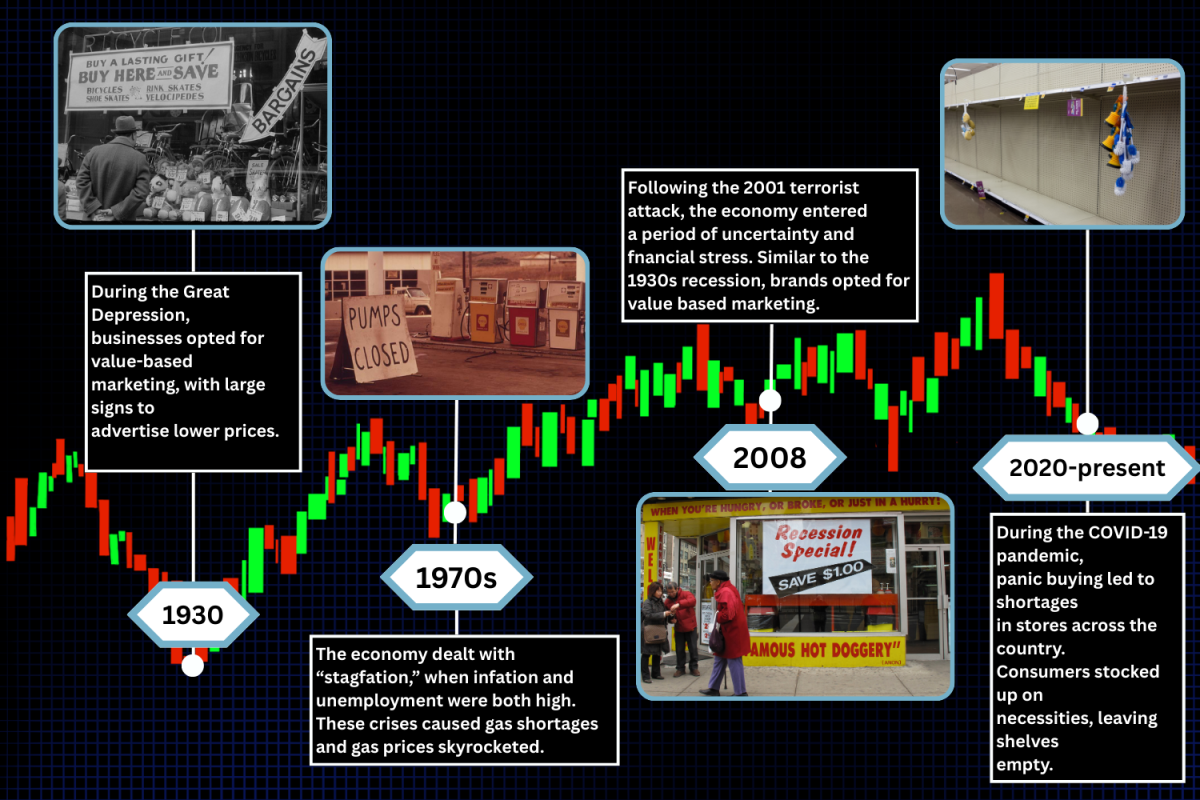

In January, minimum wages increased across the Bay Area after the enactment of Senate Bill 3 and the ongoing voting of the Fair Tax Act. With these two updates, household incomes may dramatically change in the new year, with a notable difference being that unemployed students and parents will be taxed.

Minimum wages increased across the Bay Area after the enactment of Senate Bill 3 on Jan. 1. Furthermore, on Jan. 9, Rep. Earl L. Carter introduced the Fair Tax Act to be voted on by Congress at a later date. The act would replace federal income tax with a 30% national consumption tax and abolish the Internal Revenue Service tax administrator and collector.

The regional Consumer Price Index measures the monthly changes in prices that consumers pay each year and the U.S. Bureau of Labor Statistics determines the new minimum wage. Based on the CPI, Cupertino’s minimum wage increased by 4.87%, from $16.40 in 2022 to $17.20 this year. Similarly, San Jose’s minimum wage increased by 4.94%, from $16.20 to $17.00. Increases in wages that are higher than minimum wage are up to employers to decide.

“For students earning more than minimum wage, there should be a case-by-case basis for who gets a raise,” said junior Saketh Penumudy, who works at Brighter Future Learning Center. “For example, students who work to help support family income should get a boost in wages even if they are earning more than minimum wage.”

National income tax, which would be implemented if the Fair Tax Act were to pass, would apply higher taxes on goods or services and eliminate taxes for household income. This idea was first introduced in July 1999 and has been re-proposed to Congress every two years since. The bill introduced this year differs from previous years as it also provides households with a monthly check equal to 23% of the poverty threshold for their household size.

“An earlier version of the bill would increase the federal budget deficit by $10.6 trillion over ten years,” Rep. Anna Eshoo said. “In order to make up the lost revenue from abolishing existing federal taxes, the proposed sales tax would need to be 64% — more than twice the rate proposed in the Fair Tax Act.”

The possible update in income tax wages may impact student workers negatively and positively.

“As I’m earning barely over minimum wage, income tax has taken away a lot of money,” Penumudy said. “It may not seem like a lot each time, but the amount they take away adds up by the end of the year.”

Opposers of the bill state that the rich may be subject to less taxes and the tax burden would be increased among households who aren’t earning as much money. Moreover, everyone is subject to the national consumption tax, including people who do not earn income.

“Retired seniors would be particularly impacted because they have paid taxes on their incomes for their entire working lives and will have to pay significantly higher prices,” Eshoo said.

On the other hand, supporters of the bill argue that the amount of consumption is correlated with the amount of household income earned, and therefore, the tax burden would not change significantly for anyone. The bill’s intention is to allow workers to keep more of the money that they make and push forward the ideology of consuming less and saving more. However, since people without income would also need to pay national consumption tax if the bill is passed, opponents counter that it would increase the tax burden of 90% of taxpayers and benefit only the top 10% of households.

“One of the main reasons why I work is to be able to see how valuable money is,” said sophomore Avani Khanvilkar, a worker at Saratoga Star Aquatics. “When you work, you pay more attention to how income tax and wages can have huge impacts on the amount of money you actually bring home.”

With the change in minimum wage in the Bay Area and the possibility of income tax being replaced with national consumption tax, student workers and households may encounter drastic changes in their paychecks.