Cryptocurrency ushers in new age of digital commerce

Digital cash creates new possibilities but raises new concerns

January 25, 2018

In a time of rapid innovation and modernization, cutting-edge technology has made a decentralized digital cash system a reality. The use of digital currency, or cryptocurrency, has ushered in a wave of dependable and efficient digital payment systems such as Bitcoin. With its easy accessibility and unique system, Bitcoin has become the de facto standard for cryptocurrencies and has taken the world by storm.

Created in 2009, Bitcoin became the first decentralized peer-to-peer payment network without an institution or central authority controlling it. Because users of this system stay anonymous, buyers and sellers connect with each other through encryption, which is the process of encoding a message or information so that only certain people have access to it. Bitcoin, along with other cryptocurrencies such as Litecoin and Ripple, works similar to a credit card. Both are backed by a complex system that issues currency, records transactions and allows people to exchange money electronically. The difference is that cryptocurrency is issued by an algorithm, not by a bank or the government.

“[Cryptocurrency] seems like an interesting idea since there’s no bank involved,” said Economics teacher David Pugh. “It’s like a very primitive barter system. It’s taking it right back to the most unsophisticated market where somebody brings in an ox or something similar and trades directly.”

In regard to its use, Bitcoin users install a “Bitcoin wallet,” a software program where Bitcoins are stored. The wallet allows the user to create Bitcoin addresses, which are shared with individuals the user wishes to transfer money to. The way Bitcoin addresses work is similar to how an email address works; each payment that is made is shared to the entire network and confirmed on a public ledger, which is a record of all the transactions made. Transactions are then verified and added to the ledger by “miners” — volunteers from around the world who complete complex mathematical problems to ensure that a transaction is legitimate. The complexity of these problems ensures security in volunteer credentials, and since the ledger is not controlled by a single person, one cannot cheat the system.

Bitcoin’s lack of a central authority figure adds many advantages to the system, allowing for increased freedom in payment, as users can make transactions anytime and anywhere in the world without having to go through a middleman, such as a bank. This increased freedom eliminates the need for transaction fees. Additionally, because Bitcoin allows all transactions to be anonymous, users are protected from fraud.

“Bitcoin is useful because when someone sends in money using bitcoins, he or she cannot chargeback,” said sophomore Jake Brown*. “There were several people who scammed me by paying me [in regular currency], then charge backing using their bank. Bitcoin ensures that that does not happen.”

Although Bitcoin was created in 2009, it was not until 2017 that this financial instrument surged in price and popularity. The sudden rise in its use can largely be attributed to the regulation changes in Asia. Japan, for example, formally recognized the Bitcoin in April 2017, giving more legitimacy to the system. This prompted the country’s investors to rush to the banks and swap their yen for bitcoin. In other Asian countries, heavy investment in the Bitcoin has caused the currency to soar in popularity.

“The sudden popularity may have had something to do with the banking crisis in 2007 and 2008 where many people lost all of their savings,” said Pugh. “A number of banks, including national banks, went bankrupt. People were looking for a safer option that was not subject to all of that, and cryptocurrency may have been the answer.”

The hype surrounding digital currency is yet another example of why many have turned their attention to Bitcoin. Because social media and news outlets have been buzzing about the incredible surge in the bitcoin’s value, consumers have been investing in the currency, further inflating its value. Moreover, this form of payment has been rapidly gaining acceptance in multiple industries. From small eateries to larger companies like Microsoft, many businesses have accepted bitcoin as a form of payment, and it is likely that the number of businesses that accept bitcoin transactions will continue to rise.

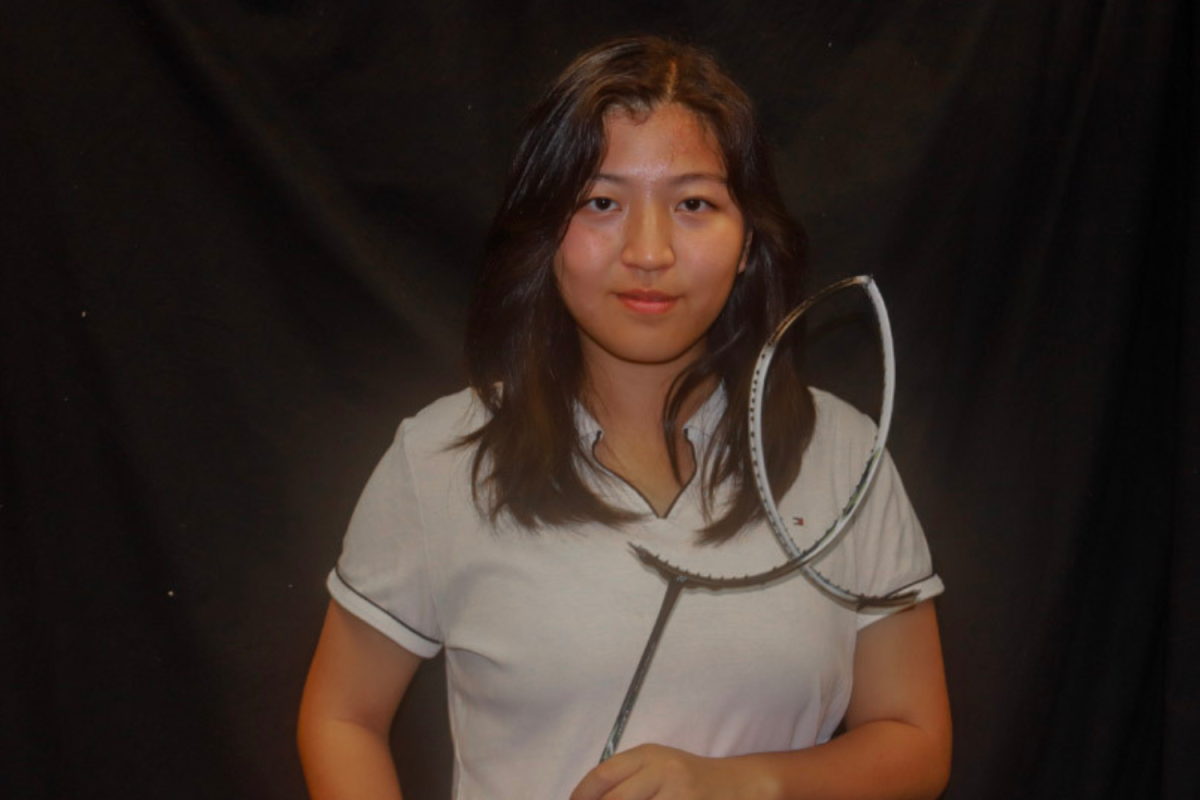

“The bitcoin seems to have gained prevalence because of the thought of convenience,” said senior Amber Hsu. “We’re moving to a digital age — we have Apple Pay, Venmo and other payment services to make everything easier, removing the hassle of credit cards and cash.”

The public’s increased interest in cryptocurrency caused bitcoin’s value to boom at an exorbitant rate, peaking at $19,000 per bitcoin in December 2017. Its value was barely in the hundreds in early 2016. This boom has attracted millions of investors, with hundreds of thousands creating Bitcoin accounts in response to the currency’s soaring value.

The technology, however, also brings a handful of drawbacks. The currency is extremely volatile, with its price constantly fluctuating. The currency now has a value well under $12,000. Its small supply but high demand is one of the main factors behind this volatility, as many retail investors are investing in bitcoins despite having only a limited number of total available bitcoins. Additionally, since the currency is relatively new, many are still uneducated about the system. This makes it infeasible for the public to solely rely on the bitcoin as a currency. Because the bitcoin does not take on a physical form, it cannot be used in stores and must always be converted into another currency before its use. Since using bitcoins as currency would require the sender to have the receiver’s cryptocurrency address, stores would have to release that information to the public or create a new account each time a transaction is made.

“If someone has any money that was obtained illegally, they could put it into Bitcoin and nobody can trace it. Bitcoin seems to be replacing the numbered Swiss bank account,” said Pugh. “However, the Swiss have been pressured to release some names of people involved in organized crime. But who do you pressure if they’re using Bitcoin? There’s no central authority. That makes it a lot more dangerous.“

The future of Bitcoin is uncertain. The crash in Bitcoin’s value immediately after its soaring prices caused many to grow skeptical about cryptocurrency. With its continuously wavering value, Bitcoin investors are unsure of whether it is the future of the economy or if it will wane. Some experts believe that the bitcoin could reach the value of $500,000 by 2020, while others state that it will drop to under $100 if it cannot overcome difficulties. Although Bitcoin is currently the most successful cryptocurrency, other forms, such as Ethereum and Ripple, have also begun to gain prevalence and may take over Bitcoin as the leading cryptocurrency.

“People are always looking for a safe haven for money,” said Pugh. “Bitcoin is safe, but volatile, so it does cause some level of economic uncertainty.”

It is no doubt that cryptocurrencies such as the Bitcoin have been gaining rapid prevalence. What is unsure is whether the Bitcoin will collapse under the weight of financial speculation or become the medium of international investment in the future; in the meantime, this currency will continue to stay in the business vernacular.

*name kept anonymous for privacy