New gas taxes drive sustainability efforts

November 2, 2017

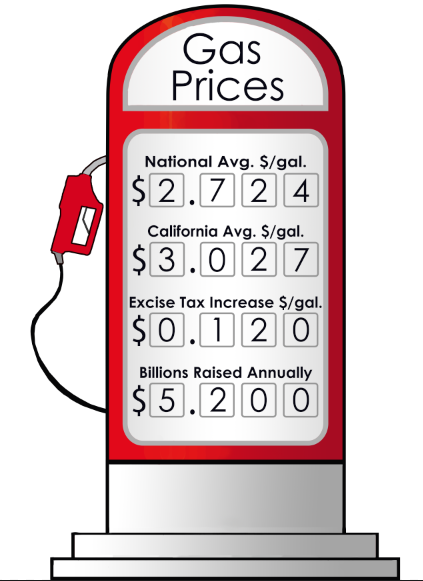

For the first time since 1993, California’s excise gas tax will be increased, from 18 to 30 cents per gallon. Currently, the average American household spends $2,140 on gas annually, with California’s gas price of $3.03 per gallon even higher than the national average of $2.72. The increasing gasoline tax aims to improve public transportation as well as encourage more people to switch from gasoline fueled vehicles to zero emission cars.

The Senate Bill 1 was passed in April 2017 by governor Jerry Brown, providing $52 billion to repair the state’s roads and railways as well as reduce traffic. By 2027, the government hopes to get 98 percent of the highways in good condition; 90 percent of culverts, or drain tunnels, in good condition; and fix 500 bridges, allocating a total of $1.89 billion annually for these projects. An additional $250 million will be allocated annually to the Congested Corridors Program (CCP), which is responsible for reducing traffic on California’s busiest roads, such as the Interstate 5 which passes through the entire state. During rush hour, the section of interstate spanning from Los Angeles to Orange County can take up to three hours to pass through. The CCP hopes to minimize the effects of these problems by using the additional funding to increase the size and number of highways and encouraging the public to use public transportation.

“This tax, it’s for the common good. We all came to school on a road, and if we want decent [roads], this tax is absolutely essential,” said Government and Economics teacher David Pugh. “Improving infrastructure is absolutely vital and California needs to catch up.”

Part of the reason for raising the gas tax was the increasing number of fuel efficient vehicles. As people began spending less money per mile of gas, cars running on alternative energy sources were introduced and the federal gas tax could no longer match government spending. In addition, gas prices have been rapidly falling since 2014, with a gallon costing $3.70 then, and $2.72 in 2017.

“I have a really old car that runs on gasoline, so with gas becoming more expensive, I would start to feel restricted or even limited, even though I don’t have to drive too much on a regular basis,” said junior Amanda White. “My family is actually considering getting an electric car. We can just charge it at home, so we won’t have to pay for gas on a regular basis.”

The U.K., India and China are several of the countries planning to ban the sale of gasoline or diesel-fueled vehicles within the next two decades. Following in their footsteps, California lawmaker and assemblyman, Phil Ting, will propose a bill to legislature to ban the sale of gasoline and diesel-fueled vehicles in the state by 2040. As of this year, zero-emission cars only amount to 4.8 percent of California cars, and three percent of car sales nationally. This ban will try to increase zero- emission car sales to 15 percent to get 1.5 million more electric or hybrid vehicles on the road by 2025.

One of the main reasons for the low sales of cleaner vehicles is the high price point. Currently, only $500 million is available in rebates for owners of zero-emission vehicles. Ting is hoping to overhaul the system to provide an additional $3 billion to be distributed to owners of zero-emissions vehicles over the course of 12 years. However, this policy has been met with skepticism as the $3 billion is six times higher than the current rebate amount.

Nevertheless, with the new gas tax being implemented this November, drivers should begin to see the benefits of paying more for their gasoline through visible improvements in our roads.